View PDF Version of Newsletter

October 3, 2023

Robert Bingham, CFA, President and Chief Investment Officer

John Wright, Principal

Jared Soper, Senior Portfolio Manager

“What happened over the last few months was basically markets were wrong because they thought inflation would come down quickly and central banks would be very dovish.”

– Frederic Dodard, State Street Global Advisors Head of Asset Allocation, (September 29, 2023)

The market got it wrong. Not only did we not get a recession in 2023, but instead, the stronger than expected growth delivered “higher rates for longer.” As a result, the stock market sold off and took a thumping in this year’s third quarter. After a strong 15.9% gain for the S&P 500 Index in 2023’s first half, the SPX fell 6.6% in August and September which wiped out July’s 3.1% gain. So for the entire third quarter, all the indices fell with the Dow Jones off 2.6%, the NASDAQ off 4.1%, and the SPX off 3.6%. Even the bond market as represented by Bloomberg’s US Treasury Index fell 3.1% in the third quarter.

This red ink in the quarter reflected changing expectations, or a realignment from an expected recession to unexpected economic growth. And while we won’t know officially until late October, gross domestic product in the United States is expected to have grown by more than 4% in the just-completed third quarter. This growth follows the 2.1% growth seen in the second quarter, and the 2.2% growth seen in 2023’s first quarter.

That said, most economists do not expect the strong third quarter growth to continue in the fourth quarter. The United Auto Workers strike has grown from an initial 12,000 workers leaving their jobs to over 18,000 workers at the end of September. While that’s not a lot of workers relative to the American work force, slower vehicle production reduces supply chain demand and hurts local communities across much of the Midwest. The UAW is also fighting the fact that currently America’s big three auto companies pay on average $66/hour in wages and benefits versus the $45/hour rate that Tesla pays its employees. Uncompetitive pricing will put both workers and companies out of business. Possible strikes by employees at Kaiser Permanente, CVS, and other companies would also weaken fourth quarter growth rates.

Bank lending standards have also been tightened following last spring’s bank failures, higher interest rates, greater regulatory supervision, and Moody’s negative outlook for bank credit ratings. Fewer new loans being made will contribute to the slowing growth rate for America’s economy. Fewer car sales should also be expected. And higher wages have also reduced the demand for new workers. Demand for commercial real estate also remains soft and will probably be so for a while. Higher interest rates hurt landlords’ abilities to refinance, as do lower occupancy rates. This sector’s rolling recession will weigh on the economy’s growth rate for some time.

So net, net, the Federal Reserve’s campaign to raise interest rates has helped slow down the economy and lower the rate of inflation from over 9% in June of 2022 to the 3.9% rate reported on September 29th. The new problem, however, is the larger amount of incremental debt the United States government now must issue to fund its substantially larger deficits. Currently, the United States pays approximately 2.9% to fund its $33 trillion of outstanding debt, according to former Federal Reserve Board member Kevin Warsh. This $33 trillion is up nearly 100% from the $16.6 trillion level seen in 2018. Fortunately, America’s economy has continued to grow strongly over this time period, so the United States still enjoys the full faith and support of creditors worldwide.

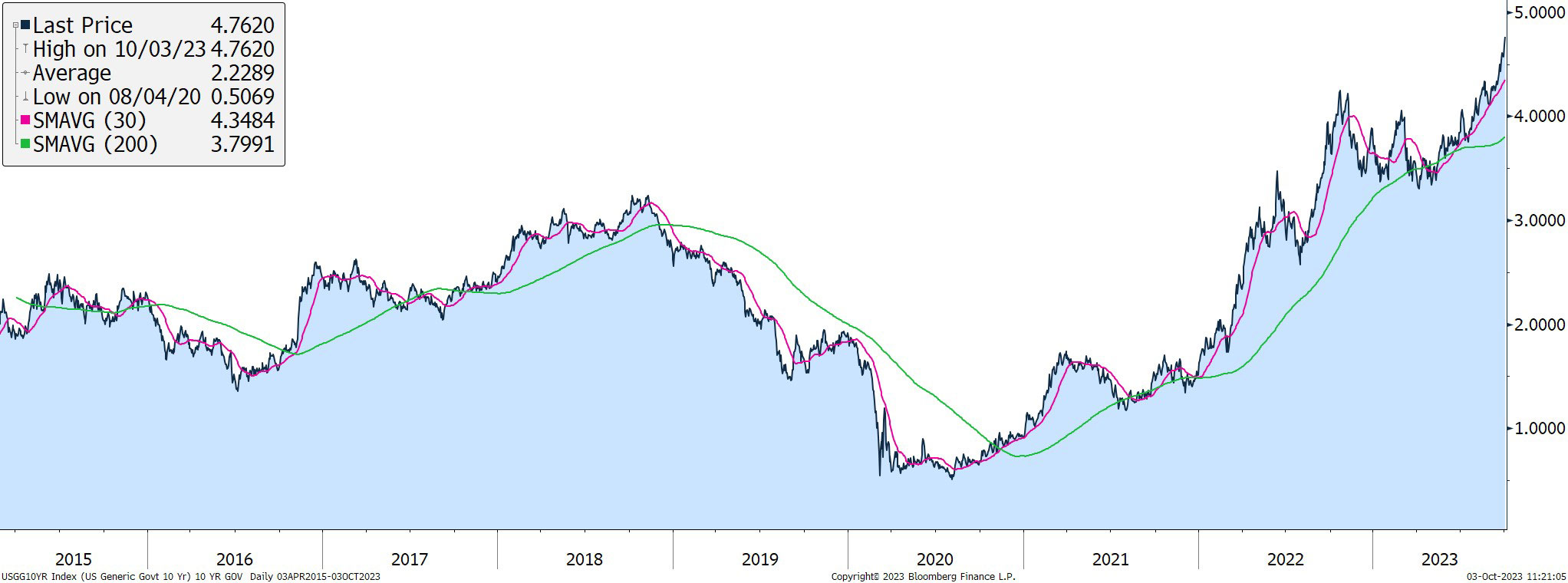

However, creditors now demand higher interest rates to buy this greater amount of debt. On September 30th, the 10-year US Treasury was yielding 4.57% which was 100 basis points, or 30%, higher from interest rates last spring as depicted in the adjoining graph.

10-Year Treasury Yield (2015-2023)

These increased interest payments will expand the size of America’s deficits and reduce the flexibility and ability of the US Government to spend money elsewhere. America’s creditors get paid first and should receive greater payments for the increased leverage and greater risks the United States has taken.

This new realization became clearer in early August when the Treasury Department announced larger than expected bond sales as being needed to fund our larger deficits this fall. Concurrently, America’s stock markets began their retreat.

Barron’s Ben Levisohn on August 14th described this incremental demand for yield, or falling bond prices, as a “bear steepener”. Such trends in the bond market only occur approximately 10% of the time according to Ned Davis of Davis Research. Joseph Kalish, Chief Global Macro Strategist at Ned Davis Research, stated on August 14th, “A bear steepener is a relatively rare, unstable condition, particularly this late in a tightening cycle.” And Kalish’s colleague, Ed Clissold, stated “The macro message is that the economy is strengthening, and the Fed is expected to hike. Put another way, the economy is getting the all-clear message, but the Fed has not overtightened.”

Such bear steepening events can cause stock markets to fall by approximately 7%, as Barry Knapp, Director of Research at Ironsides Macroeconomics, projected on 8/14/23. And effectively, that’s what investors witnessed during August and September. Dennis DeBusschere, founder of 22V Research, also believes this bear steepening caused 2023’s rapid decline in inflation. Ben Levisohn describes this all as good news since it will, “force the Fed to end this rate hiking cycle once and for all and provide a buying opportunity.”

“We are in the fear stage for Treasuries, and that won’t last. In our mind, inflation is settling, and growth will slow. We will get there in six months,” said Jack McIntyre of Brandywine Global Investment Management on September 29th. Goldman Sachs also forecasted a year-end yield of 4.3% for the 10-year Treasury, which was up from their previous forecast of 3.9%, but sharply lower than the September 30th yield of 4.57%.

“We’re reverting back to what the world looked like before 2008,” said Rob Robis, Chief Global Fixed Income Strategist of BCA Research on September 29th. That world had choppy growth rates, inflation around 2%, lower amounts of government spending, and a basic cost of capital approximating 4%. That was an era when central banks were not distorting bond markets with massive bond buying programs.

Our US Congress also averted a government shutdown on September 30th by passing a continuing resolution to fund the Federal government at 2023 levels through November 17th. This surprising announcement was good news but did not resolve any disagreements over government spending levels, agency priorities, tax and estate law, or levels of foreign aid.

The Antideficiency Act of 1884 sets the rules for government shutdowns, but various exceptions and statutes give the White House room for interpretation. Over the years the Government Accountability Office issued legal opinions for current government officials that may reduce the Biden administration’s options and choices. However, political preferences will still shape an administration’s choices on how widespread the shutdown might be. Many government agencies furlough between 20% and 80% of their workforce, or about 2 million out of 4.5 million government employees. And irrespective of any shutdown, our Congressional representatives will still receive their paychecks on time.

So shutdowns are ugly affairs, despite politicians’ good intentions, or lack thereof. Hopefully, some compromises will be found between the two party’s differences before November 17th. But most likely the rancor will continue. Fortunately, the stock market has typically weathered these storms fairly well. Keith Lerner, Truist Advisory Services Chief Investment Strategist, documents that over the last twenty shutdowns since 1976 the stock market rose 50% of the time during these shutdowns. Nothing worse nor better than any other typical day.

In this difficult market climate, what matters most are corporate earnings. While Wall Street analysts continue to expect reasonable third quarter earnings, traders want better than expected results. So we expect market volatility to continue. Corporate earnings will be examined thoroughly, and investment opportunities will be found. This year’s market results have been dominated by the largest ten stocks in the S&P 500, which has created opportunities elsewhere. Bond yields are also attractive, and we believe having more exposure to fixed income investments makes sense for many investors. We will continue to look for stocks where we can find growth at a reasonable price. And, as long-term investors, we know that time is on our side. We will continue our efforts for clients to deliver reasonable rates of return with less risk.

Do please let us know if you would like to meet with us or speak with us directly.

Securities noted above valued as of the market close on October 2, 2023:

CVS Health Corporation (CVS $69.69)

Tesla Inc. (TSLA $251.60)

These summary/prices/quotes/statistics contained herein have been obtained from sources believed to be reliable but are not necessarily complete and cannot be guaranteed. Errors and omissions excepted.