View PDF Version of Newsletter

July 3, 2024

Robert Bingham, CFA, President and Chief Investment Officer

John Wright, Principal

Jared Soper, Senior Portfolio Manager

“There are two different things pushing stocks around: demand for chips to drive artificial intelligence, and concern about the economy and interest rates.”

– James Mackintosh of the Wall Street Journal on 6/20/24

Just like last year? The first half of 2024 generated strong market returns. The S&P 500 was up 14.5% for the first two quarters versus 15.9% for the first half of 2023 when excluding dividends. In 2024 however, the stronger returns were seen in the first quarter with its 10.2% appreciation versus the S&P 500’s 3.9% gains in this year’s second quarter. In 2023, the S&P 500 appreciated by 7.0% in the first quarter and gained 8.3% in last year’s second quarter.

Last year’s strong first half gains were followed by a 3.6% decline in 2023’s third quarter; but that was after the 3.1% advance last July was erased by a 6.6% decline last August and September. While we expect volatility to return again in this year’s third quarter, we do not believe it will be as severe as that seen last year.

For starters, in 2023, the excitement over artificial intelligence was well placed, but nearly euphoric. This excitement also contrasted with 2023’s ongoing expectations for a recession. The stock market was still recovering from 2022’s severe sell-off and hadn’t yet recovered from its previous all-time highs of January 2022. Recessionary signs were also visible as both household spending and energy use slowed in 2023’s second quarter. Market investors expected interest rates to decline sharply. But, in fact, economic growth continued to be vibrant and was materially stronger in 2023’s third quarter than had been expected. The market needed to recognize that interest rates instead were going to remain higher for longer.

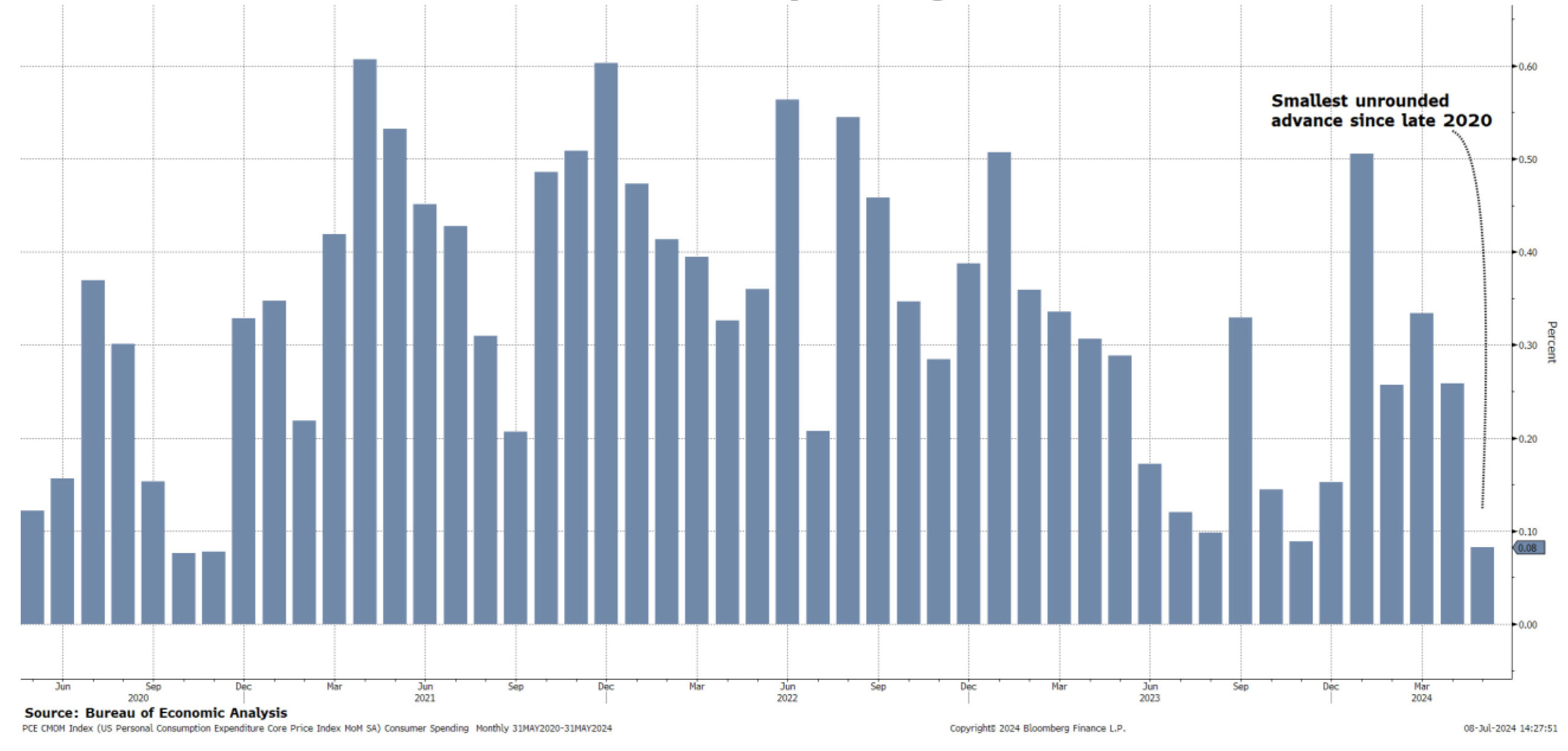

In 2024 the economy has grown much more slowly, but steadier, when compared with 2023. Many investors still expect the Federal Reserve to lower interest rates to support additional economic growth. But the Federal Reserve has remained primarily focused on our country’s inflation rate. Fortunately, as seen in the adjoining graph, the core personal consumption expenditures price index had its smallest increase since 2020.

US Inflation Cools While Consumer Spending Persists

The incremental rate of inflation has slowly been coming down after the sharp increases over the last three years. However, actual prices for goods and services are likely to remain materially higher than what we enjoyed back in 2020.

Consumers and businesses have however been adjusting to these higher prices. Consumers have been utilizing their stimulus savings to keep spending, and companies have benefited from this ongoing demand for both goods and services. Wages are up, and the size of the work force has grown.

Most importantly, demand for labor has remained strong. This demand has kept unemployment levels low while also bringing additional workers into the workforce. These healthy trends are expected to continue and should support ongoing economic growth.

However, market investors still want the Federal Reserve to cut interest rates. In fact, as June ended, traders had priced in a 95% chance of an interest rate reduction by the Federal Reserve during 2024’s second half. But according to the CME Group FedWatch tool, there was only a 20% chance of a rate cut this July and a 60% chance of a rate cut this September. The Federal Reserve will need to see additional favorable readings on inflation, like the one received on June 28th, before they lower interest rates.

Market breadth has also been narrow as the next graph shows. The strong S&P 500 has been led by those Magnificent Seven* while other market sectors have lagged. Yet part of this dichotomy is how these indices are calculated.

The S&P 500 (SPX) is a market weighted average index where larger companies have a greater impact on how much that index moves up or down. In fact, the Magnificent Seven generated 60% of the S&P 500’s returns in the first half of 2024.

In contrast, each stock in the S&P 500 equally weighted average (SPW) represents 1/500th of that index’s movement. Consequently, the technology sector has a much lower weighting in the SPW index than in the SPX index. This graph depicts that difference with the equally weighted index (SPW) only appreciating by 4.1% in the first half of 2024 versus the 14.5% gains seen for the market weighted index (SPX); quite the gap relative to the last few years.

S&P 500 Market Weighted Average (SPX) vs. S&P 500 Equally Weighted Average (SPW)

(6/30/2020 to 6/28/2024)

Effectively, the stock market’s strong first half performance was driven by the technology and communications sectors. The companies in these two sectors have had strong earnings and are well positioned to continue their growth. But artificial intelligence is increasingly being used by many companies, which is helping to improve their productivity and operating efficiencies.

The U.S. Labor Department tracks total output produced with a given input of labor. And these numbers have been materially higher over the last twelve months than they were in 2022. Such improvements have helped grow corporate earnings. FactSet’s compiled data suggest that corporate earnings will grow by 8.7% in the second quarter, 11% for all of 2024, and by 14% in 2025.

Corporate profit margins have also remained strong with the S&P 500’s net income margin at 12.4% in 2024’s first quarter. Analysts project this margin to increase to 12.7% in the second quarter and then exceed 13% in 2024’s second half.

If, in fact, corporate earnings do remain strong, and/or improve, these advances should help broaden the stock market’s breadth. Strong earnings will support the economy’s growth, which in turn should help other market sectors perform better. Much as the growth in artificial intelligence has expanded the need for electricity and helped the utility sector outperform in 2024’s first half.

But market valuations matter also. Jon Sindreu of The Wall Street Journal looked at valuations by dividing the S&P 500 companies into 50 artificial intelligence related companies and 450 other companies. The stocks for those 50 companies appreciated by 14.7% in the second quarter, while the stocks for the other 450 companies lost 1.2% in this year’s second quarter. Stocks in six of the eleven market sectors–health care, real estate, financials, energy, industrials and materials–all lost money in the second quarter. Accordingly, the stocks for these other 450 companies had a price/earnings ratio of 17.6 at the end of June versus 18.0 at the end of March. These stocks are cheaper now than they were last spring. The P/E for those other 50 stocks was 27.5 at the end of June.

If earnings do continue to grow across market sectors, that will support greater market breadth. Such progress should improve the market’s base and help support further market advances. But market corrections should always be expected, as markets don’t only move in one straight line. Having a mixed and diverse portfolio also helps to reduce risk and unwanted declines. We will continue our efforts to look for stocks where we can find growth at a reasonable price. And as long-term investors, we know that time is on our side.

Do please let us know if you would like to meet or speak with us directly. Enjoy your summer!

* Alphabet, Amazon, Apple, Meta, Microsoft, Nvidia and Tesla comprise the Magnificent Seven.

Securities noted above valued as of the market close on July 2, 2024:

Alphabet Inc. Cl C (AMZN $186.61)

Amazon.com Inc. (AMZN $200.00)

Apple Inc. (AAPL $220.27)

Meta Platforms Inc. (META $509.50)

Microsoft Corp. (MSFT $459.28)

NVIDIA Corporation (NVDA $122.67)

Tesla Inc. (TSLA $231.26)

These summary/prices/quotes/statistics contained herein have been obtained from sources believed to be reliable but are not necessarily complete and cannot be guaranteed. Errors and omissions excepted.