View PDF Version of Newsletter

July 10, 2023

Robert Bingham, CFA, President and Chief Investment Officer

John Wright, Principal

Jared Soper, Senior Portfolio Manager

“This year has been a lesson about not getting overly pessimistic.”

– William Sterling, Global Strategist at GW&K Investment Management on 6/30/23

The first half of 2023 is over, and by most counts, investors were surprised at every turn. Front and center in the markets this year has been the NASDAQ Composite Index, which increased by 31.7% in 2023’s first half – its best half year performance since 1983. This strong increase drove the better than expected 15.9% increase in the S&P 500 Index during this year’s first half. And the less tech-weighted Dow Jones Industrial Average increased by 3.8% in the first half of 2023. If we include the dividend payments in the rates of return for these three indices, the respective increases were 32.3%, 16.9% and 4.9%.

This bifurcated market was caused by two powerful variables: moderating increases in interest rates, and the growing excitement for artificial intelligence being used in the economy. Technology stocks were also oversold in 2022 when the Federal Reserve began its rapid increases in interest rates. Tech sector revenue has also held up better than expected in 2023. And interest rates have steadied. So, the NASDAQ Composite rallied sharply in this year’s first half.

The economy has also held up better than expected as the pending recession, is still pending. Gross Domestic Product for the first quarter was recently revised to have grown at 2.0% rather than the previously calculated 1.3% rate. This material revision reflects continued strong levels of consumer spending and ongoing strength in the housing market. Second quarter GDP growth is also now anticipated to have been better than expected and may approach the 2.0% level as well.

Yes, higher interest rates have softened real estate markets, but the ongoing economic growth has prevented any calamity thus far. Commercial real estate markets do however remain vulnerable as most projects carry large amounts of debt to accentuate returns. This leverage becomes more costly as interest rates rise. And according to Bloomberg News’ John Gittelsohn, commercial real estate market values have fallen by more than 20% since March of 2022. This decline has been led by office buildings which have fallen by 27%, apartment building values which have fallen by 21%, and retail malls which have declined by 18% per Green Street Advisors.

As of March 2023, office vacancy rates were over 30% in San Francisco, Houston, Atlanta, and Los Angeles, over 26% in Seattle and Chicago, over 22% in Philadelphia, and about 19% in New York City. Demand for office space has declined as more people work from their homes. Higher financing costs have also hurt.

According to the Mortgage Bankers Association, about $1.4 trillion of commercial real estate debt comes due for payment over the next 18 to 24 months. Such mounting pressures have led some to restructure debt and be proactive, so possibly, no full breakdown will occur. But commercial real estate investors are currently reassessing their exposures, their risks, and prospective returns. Capital Economics does not believe office property values will fully recover until 2040. So while near-term risks appear manageable, a restructuring is taking place. And in the second quarter, these concerns seemed to moderate as junk bond spreads improved to 4.14% from 4.58% over US Treasuries.

Meanwhile, the economy has continued to grow. Job growth has slowed, but it continues at a healthy pace. In July’s first week, both ADP’s National Employment Report and the Labor Department reported healthy job growth. Much of the recent demand for labor has come from builders, engineers, architects, real estate agents, auto and parts manufacturers, and the health care industry. The number of workers at restaurants, hotels, schools, and government offices continues to increase as demand for services increases.

Wage growth has also remained healthy, but with more moderate increases. Deutsche Bank Senior U.S. Economist Brett Ryan highlighted this increased concentration in service sector hiring in his recent report, corroborated by the July 7th jobs report. This released data showed that U.S. nonfarm payroll growth remained above the pre-pandemic averages, but down from the stronger levels seen over the last twelve months.

However, many economists do believe the rate of economic growth is slowing which should help to keep inflation in check. On June 30th, the Commerce Department announced that its personal consumption expenditures price index rose by 3.8% in May, which was its lowest reading in two years. The core rate of inflation also declined slightly but was still at a high 4.6% rate. Levels of household spending also slowed in May but still remained at an “elevated level” according to Wells Fargo Economist Shannon Seery. Prices for a subset of services excluding housing and energy rose by 3.9% during the second quarter versus the 5.3% rate seen in 2023’s first quarter according to the Wall Street Journal’s Nick Timiraos. More inflation data with incremental insight will be released in the succeeding weeks and months.

In the first quarter, household spending increased at a 4.2% rate which was the strongest quarterly level seen in two years. This spending rate is expected to have fallen below 1% in this year’s second quarter which in turn may reduce the rate of GDP growth. But still no broad spread recession is expected in the near term. Fortunately, lower energy prices and healthy job growth have helped maintain economic growth. In fact, the United States may have absorbed a rolling recession across different sectors at different times, rather than experiencing a full pullback in all sectors at the same time.

Corporate earnings have also held up much better than expected. In the first quarter, Wall Street analysts had expected earnings for the S&P 500 companies to decline by 5.1% versus 2022 levels. And instead, earnings were flat versus year ago levels which was a materially better than expected result. In fact, over 70% of the S&P 500 companies beat expectations which helped fuel the second quarter’s strong stock market.

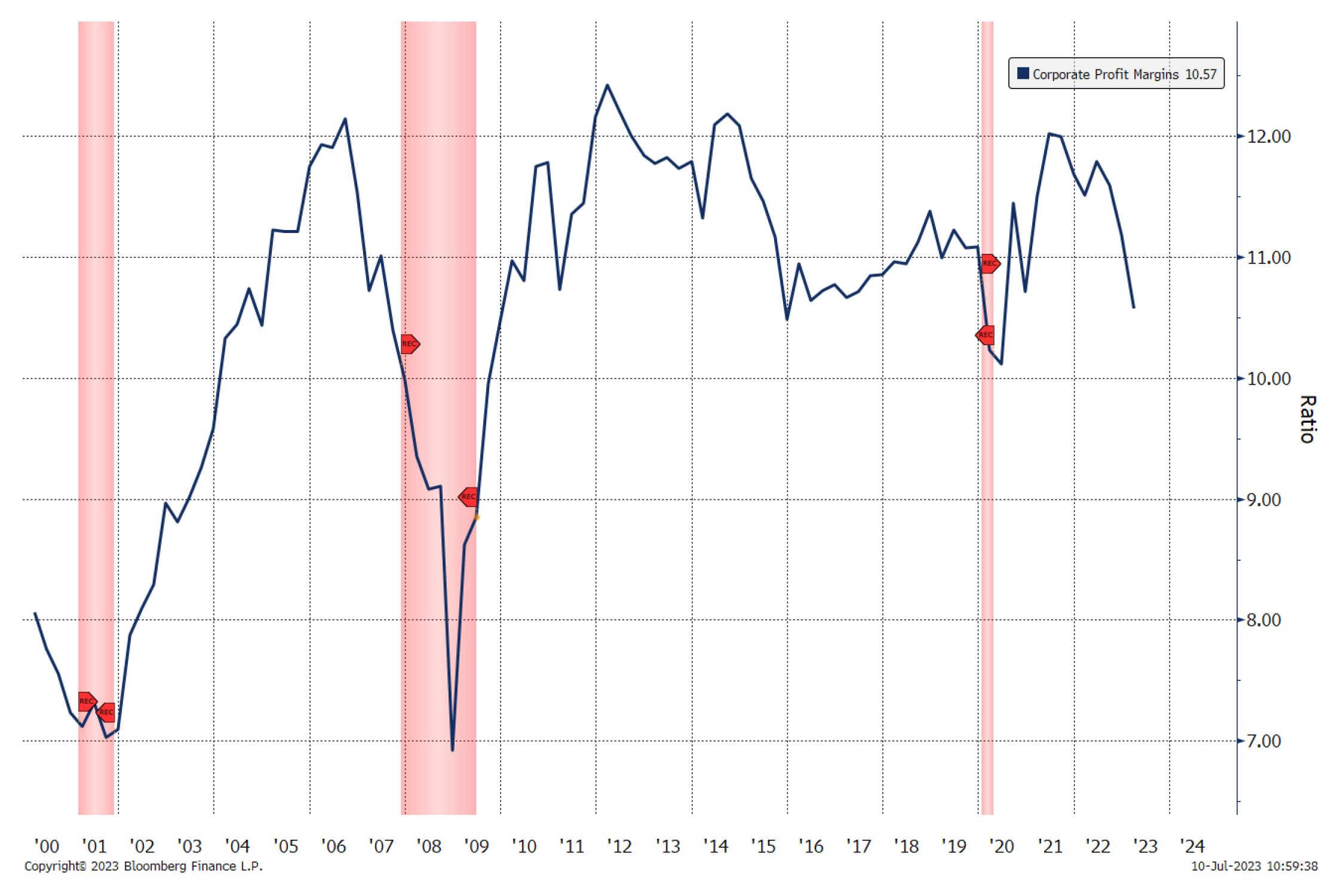

But profit margins did decline in the first quarter to 10.57% as is represented in the adjoining graph.

Corporate Profit Margins (2000 to 2024)

Higher wages, higher material costs, and lower rates of productivity hurt results. And margins likely remained under pressure in the second quarter. So, analysts once again have not expected overly strong corporate earnings in the second quarter. But after spending ten years to improve their profit margins, companies will fight hard to maintain these double-digit levels. Lower rates of inflation should also help profit margins. Time will tell.

The Federal Reserve is also expected to increase their Federal Funds rate on July 26th and maintain these higher rates for the rest of 2023. But companies are also adjusting to the “higher for longer” interest rate environment and will work hard to improve their rates of productivity. And if interest rates are peaking, that will also help the market sentiment for stocks.

Market breadth has also improved in the stock market since the end of May. The S&P 500’s equally weighted index (INDEX) outperformed its market-weighted index (SPX) with a 7.8% return versus 6.6% for the SPX in June. Smaller market capitalization companies as reflected by the Russell 2000 Index (RTY) were up 8.1% in June versus the SPX’s 6.6% return. Consumer Discretionary, Industrials, and Material stocks all outperformed the SPX’s 6.6% June return.

This increased market breadth will help better support the stock market in 2023’s second half. In fact LPL Chief Technical Strategist Adam Turnquist reported that, “Since 1950, first-half gains of 10% or more have been followed by an average rally of 7.7% in the second half – with positive results 82% of the time.” Such perspective may also lead investors to once again “buy the dip” on market pullbacks.

So, we remain comfortable with our market exposures as the second half of 2023 begins. We will maintain our focus on quality companies and maintain balanced levels of risk. While this approach kept our results in check during 2023’s first half, it fueled our outperformance in 2022’s down market. This investment approach reflects our goal to deliver reasonable rates of return with less risk.

Do call us with any questions or let us know if you would like to meet during these summer months.

These summary/prices/quotes/statistics contained herein have been obtained from sources believed to be reliable but are not necessarily complete and cannot be guaranteed. Errors and omissions excepted.