View PDF Version of Newsletter

January 6, 2024

Robert Bingham, CFA, President and Chief Investment Officer

John Wright, Principal

Jared Soper, Senior Portfolio Manager

“The market got way too ahead of the Fed.”

– Rick Rieder on January 5, 2024

BlackRock Chief Investment Officer of Global Fixed Income

Markets tend to be uncertain, and they can even be spurious. They go up, they go down, and often they just go sideways. One never knows. They do have minds of their own, and they do reflect trillions of ideas, expectations, possibilities, and emotions. Inherently, they are unpredictable. But over time, they do trend higher as economies grow and new technologies improve worker productivity. In fact, Ryan Detrick, the Chief Market Strategist at Carson Group, calculated that historically the S&P 500 Index increases each year 71.2% of the time. The stock market’s average annual gain has been 8.1% over the last 50 years, but it’s actually 11.2% if corporate dividends had been regularly reinvested in the market.

The exceptionally strong 2023 gains were truly more of a rebound from the oversold market of 2022, when the S&P 500 Index fell by 18.1% after including dividends. So 2023’s rally returned the market to where it had been before 2022’s fear and panic set in. This fear was caused by exceptionally strong inflation rates and an increasing interest rate policy set by the Federal Reserve.

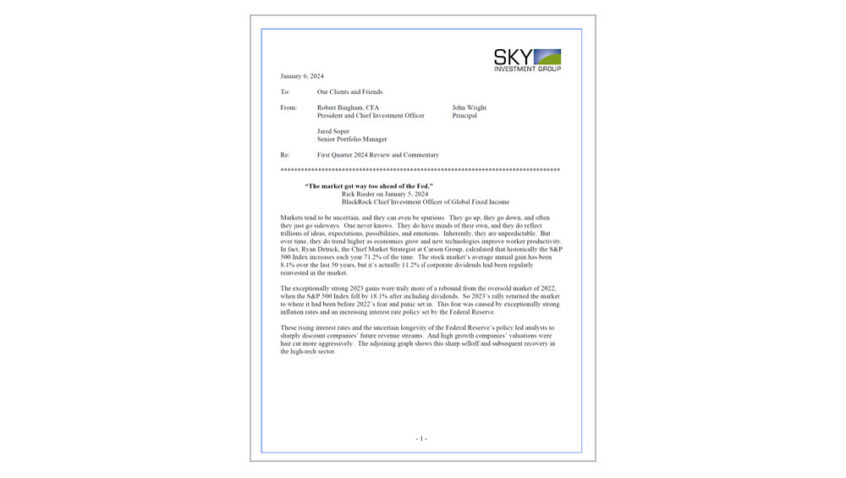

These rising interest rates and the uncertain longevity of the Federal Reserve’s policy led analysts to sharply discount companies’ future revenue streams. And high growth companies’ valuations were hair cut more aggressively. The adjoining graph shows this sharp selloff and subsequent recovery in the high-tech sector.

S&P 500 Information Technology Sector (12/31/21 to 11/3/23)

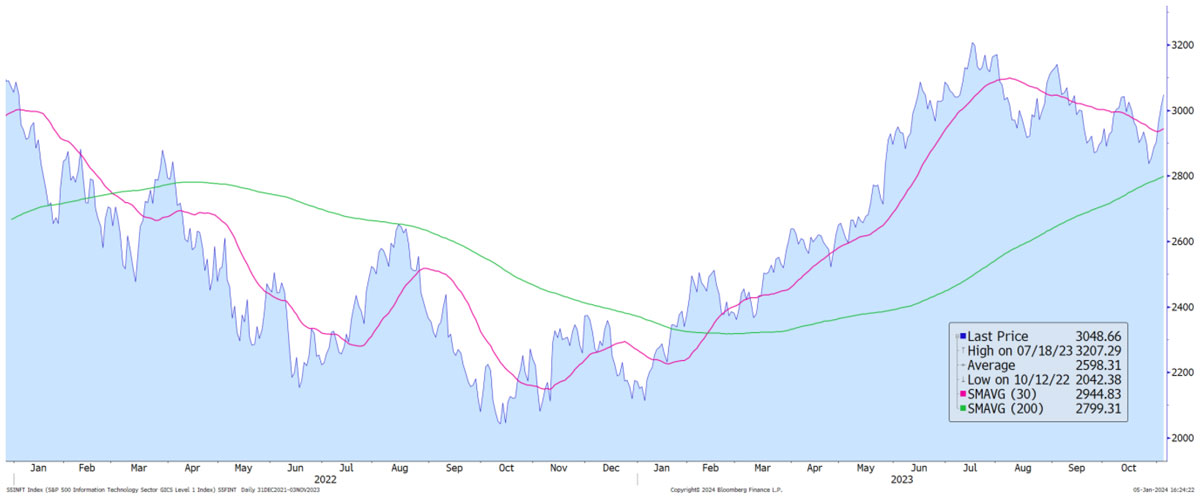

Strong earnings from Nvidia, Microsoft, and other high tech companies last spring led the tremendous rebound and market turnaround. This strong bounce in 2023’s first half was interrupted in the third quarter by announcements from the U.S. Treasury that it would need to issue a record level of debt in the second half of 2023 to finance our country’s growing deficit. The following graph from SIFMA Research depicts the U.S. Government’s gross Treasury issuance over the last twelve years.

Obviously, the Covid-19 stimulus appropriations drove much of the increase in U.S. government debt issuance. But recently passed legislation is driving the more recent increase. The stimulus appropriations were also one-time expenditures versus the newly embedded requirements from the Bipartisan Infrastructure Law, the CHIPS Act and the Inflation Reduction Act. Once again, our elected officials are asking our economy to grow into these larger spending obligations.

Ongoing economic growth combined with greater worker productivity could make this possible. The economy did grow more than expected in 2023, even with some weakening trends seen in the fourth quarter. Yet December’s strong markets were replaced by some weakness in January’s first week as investors recalibrated some changing expectations for interest rate cuts. At year-end, the fed funds futures markets had priced in a 66% chance for a 25-basis point cut in rates this March and a 93% probability of another rate cut by the end of May. However, stronger than expected growth in December’s labor market brought these percentages down materially to 53% and 41% respectively on January 5th.

Obviously, these probabilities change often with each passing minute or every newly released data regarding the health and strength of our economy. The chief concern is that this embedded volatility in the futures markets could easily spill over into the bond and stock markets. And the growing amount of debt our government needs to fund itself doesn’t help.

Bond traders are very active and very detailed as they focus on every basis point move in interest rates. Strong growth in the demand for money market funds has tempered some of this inherent volatility in the bond market. But with so many investors chasing short-term yields, the U.S. Treasury’s issuance of shorter-term Treasury bills has grown from 10% of total government debt to 21% over the last seven years. Our U.S. government has therefore become that much more dependent on the shorter-term whims of traders and investors. Any surprise in the bond market will directly impact the stability of the stock market.

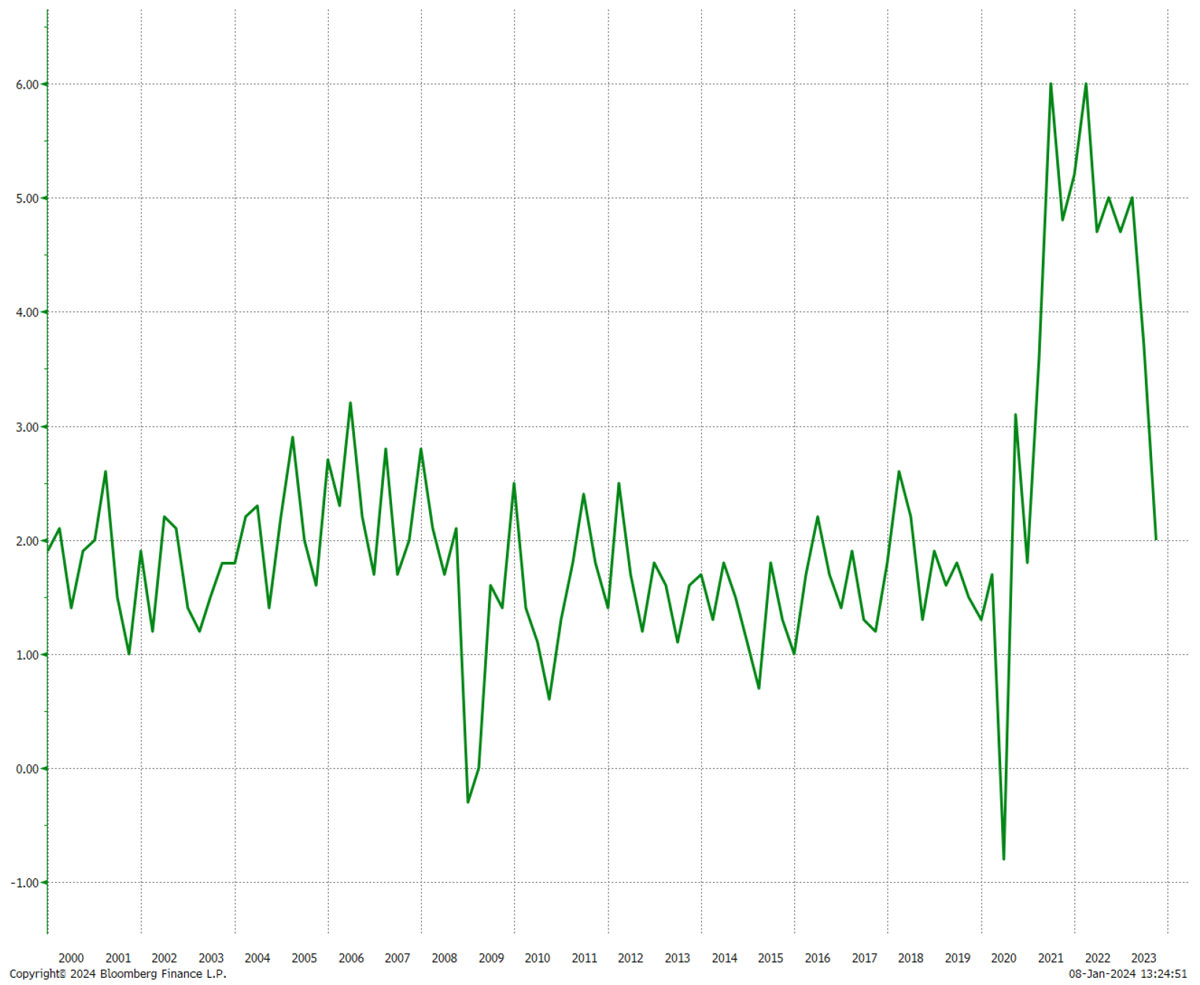

The good news however is that inflation rates did decline sharply in 2023. The Core Personal Consumption Expenditures Price Index as reported in December showed inflation growing at a 2% rate for the prior three months and six months of 2023. This news allowed the Federal Reserve to ”pivot” and indicate that interest rate cuts should be expected in 2024. The stock market rallied sharply in December as a result. The adjoining graph depicts the inflationary trends our country has faced over the last 23 years.

Core Personal Consumption Expenditures Price Index (2000-2023)

If inflation does indeed remain quite moderate, then interest rates will trend lower. Yet the economy does also need consumers and businesses to continue to spend and to invest. Markets have been hoping for an economic soft landing, but only time will tell what 2024 will bring. Fortunately, estimates for corporate earnings remain attractive. Consensus earnings per share for the S&P 500 companies were projected to grow by 7.7% in 2024 over 2023 levels as the new year began. And 2025’s consensus also projected a 12.5% growth rate over 2024 levels. These expectations could be overly optimistic, but at least most analysts have not been expecting a recession. Steady growth should be expected.

Accordingly, at SKY, we will continue to focus on quality companies with good earnings trends. We will continue to look for stocks where we can find growth at a reasonable price, and we will continue to focus on not chasing rallies and overpaying for our investments. Market volatility should be expected again this year, and, hopefully, ugly politics and bloody battles won’t dominate the headlines. Just don’t let your opinions on politics dictate your investing habits.

We hope you all enjoy a Happy New Year and do call us with any questions.

“I think you just let things shake out. Be patient; no reason to be a hero.”

– Douglas Busch, ChartSmart author and proprietor on 1/4/24

Securities noted above valued as of the market close on January 5, 2024:

Microsoft Corporation (MSFT $367.75)

NVIDIA Corporation (NVDA $490.97)

These summary/prices/quotes/statistics contained herein have been obtained from sources believed to be reliable but are not necessarily complete and cannot be guaranteed. Errors and omissions excepted.