View PDF Version of Newsletter

October 8, 2022

Robert Bingham, CFA, President and Chief Investment Officer

John Wright, Principal

Jared Soper, Senior Portfolio Manager

“Inflation is the number one, two, and three most important data point.” – 10/7/22

– Alex Chaloff, Bernstein Private Wealth Management, Co-Head of Investment Strategies

Is good news bad news, or is bad news good news? Such was the state of the markets as October 2022 began. During the third quarter, markets became short-term oriented, very data focused, and data reactive. This combination increased the volatility, choppiness, and meandering in both the stock and bond markets. But as the markets floundered and looked for direction, they also created opportunities for long-term investors.

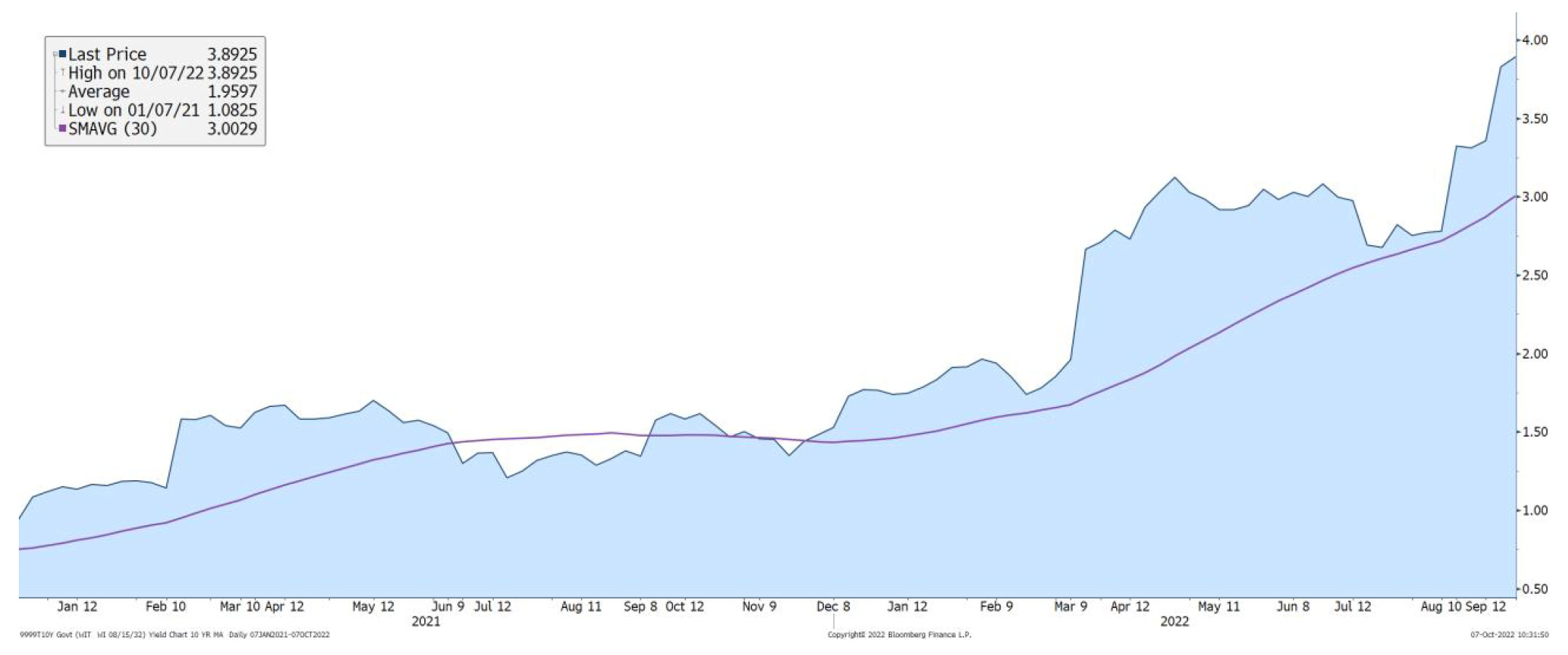

Most of this volatility occurred because the Federal Reserve rapidly increased interest rates. The graph below shows how interest rates have increased more than three-fold over the last two years, as depicted by the yield on the 10-year US Treasury bond.

10-Year US Government Treasury Yield (2021-2022)

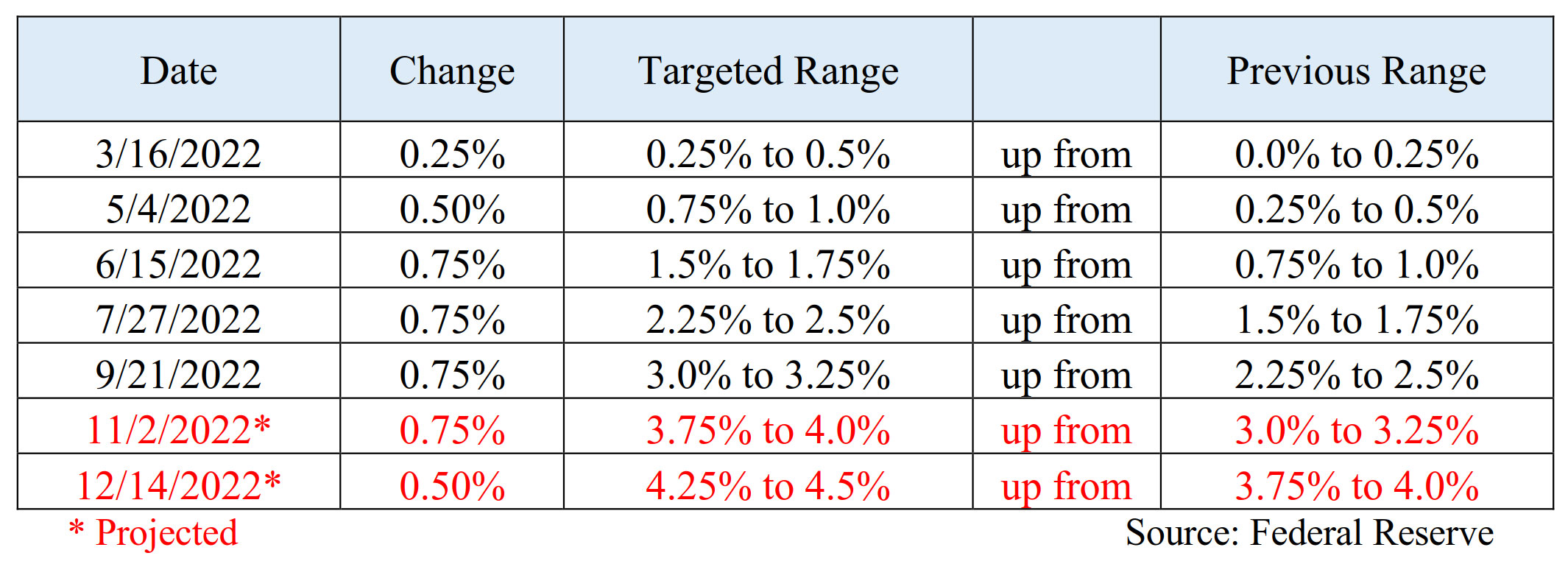

The next table lists the actual changes to the federal-funds rate as it climbed above 3.00% from 0.00% within the last six months. These increases have been the fastest pace of Federal Reserve increases since Fed Chairman Paul Volker’s era in the early 1980’s. Yet, as many of the Fed Governors have stated, they are reacting to the high pace of inflation and the need to curtail inflationary pressures and expectations.

Federal Funds Rate Changes in 2022

Unfortunately, interest rates are a macroeconomic tool being used to combat microeconomic problems. This tool is a blunt instrument without much precision or exact aim. Consequently, all sectors of the economy will likely suffer and slow down from this rapid increase in interest rates.

That being said, this increase is off a low base as the fed-funds rate has been at historically low levels (near 0.00%) for most of the last fifteen years. Gradual increases were seen in the 2016- 2018 period before they were reduced back towards zero because of the pandemic. Businesses and individuals alike became very accustomed to this low-rate environment. And all the increases have shocked some market participants.

One of the most visible shocks has been seen in the mortgage markets, where 30-year residential mortgage rates more than doubled from 3.0% to 6.3%. Accordingly, that increase has lowered purchasing demand for houses, and in turn, demand for home builders and some construction workers.

Yet, the labor market remains tight with the unemployment level falling to 3.5% on October 7th, while wage growth continued to increase at a +5% annual rate. This good news for people working and those seeking employment, was bad news for the markets since the data encourages the Federal Reserve to raise their fed-funds rate again by 75 basis points at their next meeting on November 2nd.

Accordingly, both the stock and bond markets sold off strongly after the October 7th report. But after strong gains in both markets during October’s first few days, markets were still higher on October 7th than they were at the end of September. This market dance of two steps forward followed by one step backwards will likely continue into the 4th quarter.

Investors want to know when the Fed will slow down its increases in the fed-funds rate. Any hopes of just a 50 basis point increase at its November 2nd meeting were dashed by the healthy report on the labor markets released October 7th. Inflation data will similarly be scrutinized when it is released the middle of October, and many expect that data to also encourage the Fed to raise rates by 75 basis points on November 2nd.

However, the Federal Reserve would still prefer to engineer a soft landing rather than induce a full borne recession. Whether or not the Fed can pull off this miracle remains to be seen. But as we have stated previously, we still believe any recession will be mild. So, any abatement from the 75 basis point pace of increases will be viewed very positively by both the bond and stock markets. We encourage investors to be positioned for that transition.

Yet inflation is a genuine problem, and thankfully the Federal Reserve is attacking that problem. The Fed’s efforts have also increased investors’ rates of return on cash. As of October 7th, investors could buy 6-month to 3-year US Treasuries and get better than 4.0% yields. Some money market yields at our various custodians were also paying more than 2.0% as of October 7th. These attractive rates of return for cash provide conservative alternatives in a difficult market.

Importantly, this change in yields is a return to normal because capital now costs something to borrow. As stated before, no one should give up their cash for free. This transition away from an environment with 0.00% interest rates has brought some dislocations. To date, however, the dislocations have been minimal. The Fed’s move from Quantitative Easing into Quantitative Tightening has also had an impact by reducing market liquidity. Hopefully, the underlying amount of leverage in America’s economy will be better managed than seen recently in Great Britain.

Corporate earnings are also being released for the recently completed third quarter and these results will be examined carefully. Yet, just maybe, these results on average will be better than expected, as was the case for the second quarter’s earnings reports. However, management’s views and comments about a pending recession will be telling, particularly if company profit margins decline noticeably.

So as markets fight through this bear market, there is reason for some optimism. Federal Reserve Governors have signaled that their fed-funds rate should stabilize around 4.5%. And futures markets as of October 7th had already priced in a 4.6% rate for next March. With two more rate increases anticipated by year end, we may be closer to a Fed pivot away from raising rates before the end of 2022.

Markets will also have digested three more months of inflation data, two more months of employment data, third quarter earnings reports, and many other economic indicators before 2022 ends. So, while we cannot perfectly forecast the market’s bottom, we can identify value and do believe that long-term investors should be attracted to current market prices. Such interest, combined with steady profit margins, could provide support for a 4th quarter rally. Time will tell.

Do please let us know if you would like to meet with us or speak with us directly. Enjoy this Fall season!

These summary/prices/quotes/statistics contained herein have been obtained from sources believed to be reliable but are not necessarily complete and cannot be guaranteed. Errors and omissions excepted.