View PDF Version of Newsletter

April 5, 2020

Robert Bingham, CFA, President and Chief Investment Officer

John Wright, Principal, Director of Research

“If I’m short-selling, I’m betting against science.”

– Jim Cramer, CNBC Market Analyst on 3/20/2020

COVID-19, What A Monstrosity! Never in the world’s history have governments across the entire globe shut down their economies to fight a single pandemic. And not since the 1918 Spanish flu have governments faced a plague of this magnitude within weeks, or months, of one another. Truly, these are unprecedented times. But these unprecedented events have also created exceptional opportunities and possibilities.

More importantly however, we do send our hope and compassion to you, your families and friends, that you stay safe, remain healthy, and manage through this crisis as best possible. All of us will be impacted by this coronavirus, it’s just a question as to what degree. So, focus on your health and well-being, and leave your financial worries with us. Nothing in life comes easily, but there are always new choices and new opportunities.

For instance, who’s active on the front lines in this fight against COVID-19? Abbott Laboratories, AbbVie, Biogen, Clover Health, Gilead Sciences, GlaxoSmithKline, Johnson & Johnson, Microsoft, Moderna, Pfizer, Regeneron Pharmaceuticals, Roche Holding, Sanofi, Thermo Fisher, and Vir Biotechnology are just some of the companies fighting this disease directly. And Gilead Sciences and Moderna have already treated more than 2,000 patients with their experimental medications.

The Food and Drug Administration has established a Coronavirus Treatment Accelerator Program to fast-forward the regulatory path for new treatments. The Gates Foundation, the Zuckerberg Initiative, Mastercard, and London’s Wellcome Trust have funded the COVID-19 Therapeutics Accelerator to help identify and develop treatments for this virus. Additionally, the QBI Coronavirus Research Group with hundreds of scientists from the University of California, San Francisco and other institutions have already identified 69 existing drugs that combat COVID-19.

Ever since China released the gene sequencing for this SARS-CoV-2 coronavirus in January, many of the world’s best scientists have been working to combat the COVID-19 disease. By using artificial intelligence and CRISPR gene-editing technology, data has been created for protein-protection interaction maps that are used to predict which drugs might be most effective at winning this fight. Dozens of vaccines have been created and are being studied. In fact, Spain’s Science Minister Pedro Duque, said on April 2nd, “Likely before the end of April, we’ll have a vaccine candidate.” Spain’s National Center for Biotechnology, along with everyone else, clearly wants to win this fight against COVID-19.

Yet in the interim, there’s been a massive amount of pain and destruction to absorb. The stock market fell by 19.6% in the first quarter, as measured by the S&P 500 Index when including dividends. And fortunately, virtually all our client portfolios performed better than that.

But more painful has been the huge level of job losses seen both in the United States and around the world. On April 3rd, the unemployment rate in the United States increased from 3.5% to 4.4%. But these figures don’t include the 10 million Americans who filed for unemployment benefits during the last two weeks of March. Another 10 million Americans will file for unemployment benefits in April – which means our country’s unemployment rate may reach 15% in May.

Yes, our country, along with most every other country in the world, is in a very severe recession. This economic tragedy combined with the death and illness from COVID-19 has brought everybody to their knees.

High unemployment rates will persist for some time, economic growth rates have turned negative, and cash flows for individuals and businesses have declined. What everyone wants to know is, “How long will this last? How long must we maintain social distancing? How long will we be out of work? When can we get haircuts? When will restaurants reopen? When might we be able to travel freely again?”

The answer is, “Nobody knows.” But the stock market’s job is to make predictions. It’s not always right, but it does discount back into today’s price levels the future cash flow, earnings and prospects for companies and industries across the world. All companies and industries are being negatively impacted by this coronavirus. Some worse than others, but we’re all facing a very big fight.

Importantly, those with strong balance sheets, adequate liquidity, and low debt levels will come back sooner than those that operate with more leverage. While many unknowns remain, the fight is clearer and better defined than it was one month ago. During March, the coronavirus invaded the western world. Its tenacity and its viciousness became apparent. Solutions seemed imponderable, as did the financial cost and impact from this virus.

Accordingly, investors raced to sell assets. Stocks were sold, bonds were sold, gold and other commodities were sold. Every asset class fell sharply in value. Historic correlations between asset classes evaporated, and some portfolios were forced to sell anything just to meet margin calls. Large mutual funds had to meet redemptions, 16 levered ETFs failed, investors wanted cash, and credit markets stopped functioning.

Fortunately, the Federal Reserve System stepped in to provide liquidity by buying bonds, extending credit and piecing together the broken pipes in our financial system. The Federal Reserve also had to serve as a lender of last resort to other central banks and markets across the world. Once again, the United States had to use its balance sheet to stabilize our country along with others. Congress’ three stimulus packages will also provide needed support for many of the unemployed and closed businesses.

But the healing process will take time. News headlines will remain ugly, if not unbearable, for a while. Bankruptcies will grow noticeably as will morbidity rates. Families, communities, and businesses all will stumble. However, unlike 2008, when banks across the world failed, this time America’s banks are strong and will be able to extend a helping hand. That’s a material distinction, because every healthy economy needs a sound banking industry to extend credit and further economic growth. That ingredient was missing during the 2008/09 recession and elongated that period’s economic recovery. America’s strong banking industry will accelerate the economy’s recovery later this year and into 2021.

The 2008/09 recession also bottomed out with a -2.2% decline in gross domestic product during 2008’s 4th quarter. This year’s recession is expected to bottom out in the 2nd quarter with a -8.5% decline in America’s GDP, much worse and more severe than most anything our country has ever experienced.

Goldman Sachs has the Street’s most negative expectations for America’s 2nd quarter GDP with a -34% annualized decline, or -8.5% for the 2nd quarter. But they also have forecasted a +19% annualized growth rate for America’s 3rd quarter, or +4.75%. Such an economic rebound would be just as unprecedented as the rapid and sharp market declines witnessed in March.

We do not expect our country’s economic rebound to occur that quickly, but we do think it’s possible. A more likely recovery will take the shape of the letter U rather than a sharp recovery like the letter V. Either way, we believe that the severity of the current problems is better understood now (and perhaps more quantifiable) than was the case in March.

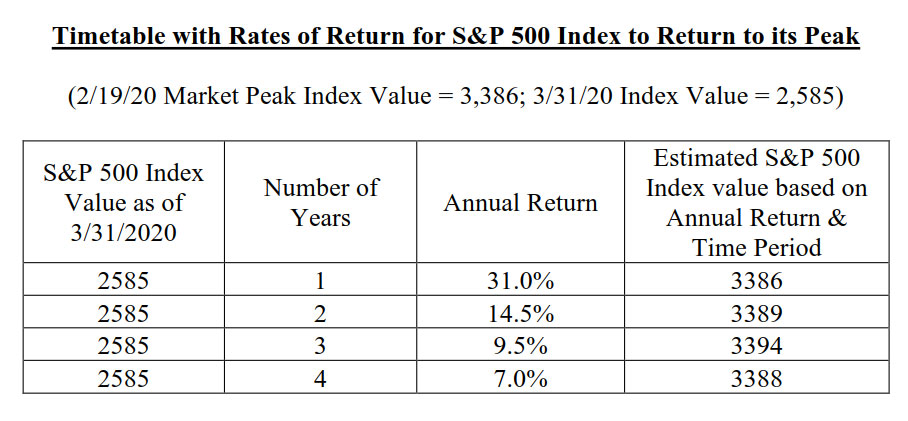

Interestingly, the S&P 500 Index fell by 35% from its peak on February 19th to its trough on March 23rd, or nearly equal to Goldman Sachs’ expectations for an annualized decline of 34% in GDP. And that decline created an opportunity because at some point, the economy will recover. Perhaps that recovery will happen in one year, or perhaps in two years, or three, or four. If that recovery materializes over the next four years, then the S&P 500 Index should revisit its February 19th high sometime in 2023. And from its March 31st closing price of 2585, investors would earn an annualized rate of return of nearly 10% if that were to happen. The table below reflects other possible timetables and rates of return.

Keep in mind that typical recessions last for about 12 to 18 months. Also keep in mind that event driven bear markets typically last no longer than 9 months. After 9/11’s tragedy, the stock market was trading at higher levels in December than it had been prior to 9/11. The horrors from 9/11 dented America’s economy, but it didn’t break.

The 2008/09 recession lasted about 18 months and did break our economy, but only temporarily. In 2020, we are relying on social distancing and unemployment checks to create some stability. But if some new antivirals are found to be effective, and/or if a vaccine materializes for COVID-19, these developments would likely spark a strong stock market rally. So while the negative impacts from the 2020 recession will be huge, this recession may only last a few months.

Such is the quandary we face. We’re quarantined, we’re unsure, and the world has changed dramatically. Many doctors believe that how we practice medicine in the future will improve materially because of this crisis. Data analytics, tracking apps, and modern technology will improve operating protocols in hospitals, governments, and businesses alike. Community health and safety may improve as well. Change is all around us.

While this abrupt shock is the largest hit to the global economy in modern history, one might be able to say that it’s already priced into the stock market. That’s not to say the stock market won’t retest previous lows with sharp levels of volatility – but change and opportunity abound. And the stock market’s sharp drop created this opportunity. Accordingly, we think this is a great time to rebalance portfolios and make sure investors structure their portfolios as they want. Market corrections provide such opportunities to reassess and start afresh.

Please give us a call if you have questions or want to visit.

Securities noted above valued as of the market close on April 3, 2020:

Abbott Laboratories (ABT $79.45)

AbbVie Inc. (ABBV $73.37)

Biogen Inc. (BIIB $300.51)

Clover Health (Private Company)

Gilead Sciences Inc. (GILD $78.21)

GlaxoSmithKline PLC (GSK $37.14)

Johnson & Johnson (JNJ $134.17)

Mastercard Inc. (MA $237.03)

Microsoft Corp. (MSFT $153.83)

Moderna Inc. (MRNA $34.84)

Pfizer Inc. (PFE $33.64)

Regeneron Pharmaceuticals, Inc. (REGN $493.32)

Roche Holding AG (RHHBY $41.12)

Sanofi (SNY $44.83)

Thermo Fisher Scientific Inc. (TMO $282.21)

Vir Biotechnology Inc. (VIR $29.00)

These summary/prices/quotes/statistics contained herein have been obtained from sources believed to be reliable but are not necessarily complete and cannot be guaranteed. Errors and omissions excepted.