View PDF Version of Newsletter

October 8, 2024

Robert Bingham, CFA, President and Chief Investment Officer

John Wright, Principal

Jared Soper, Senior Portfolio Manager

Tyler Waterman, Portfolio Manager, Director of Research

“Progress is impossible without change, and those who cannot change their minds cannot change anything.”

– George Bernard Shaw

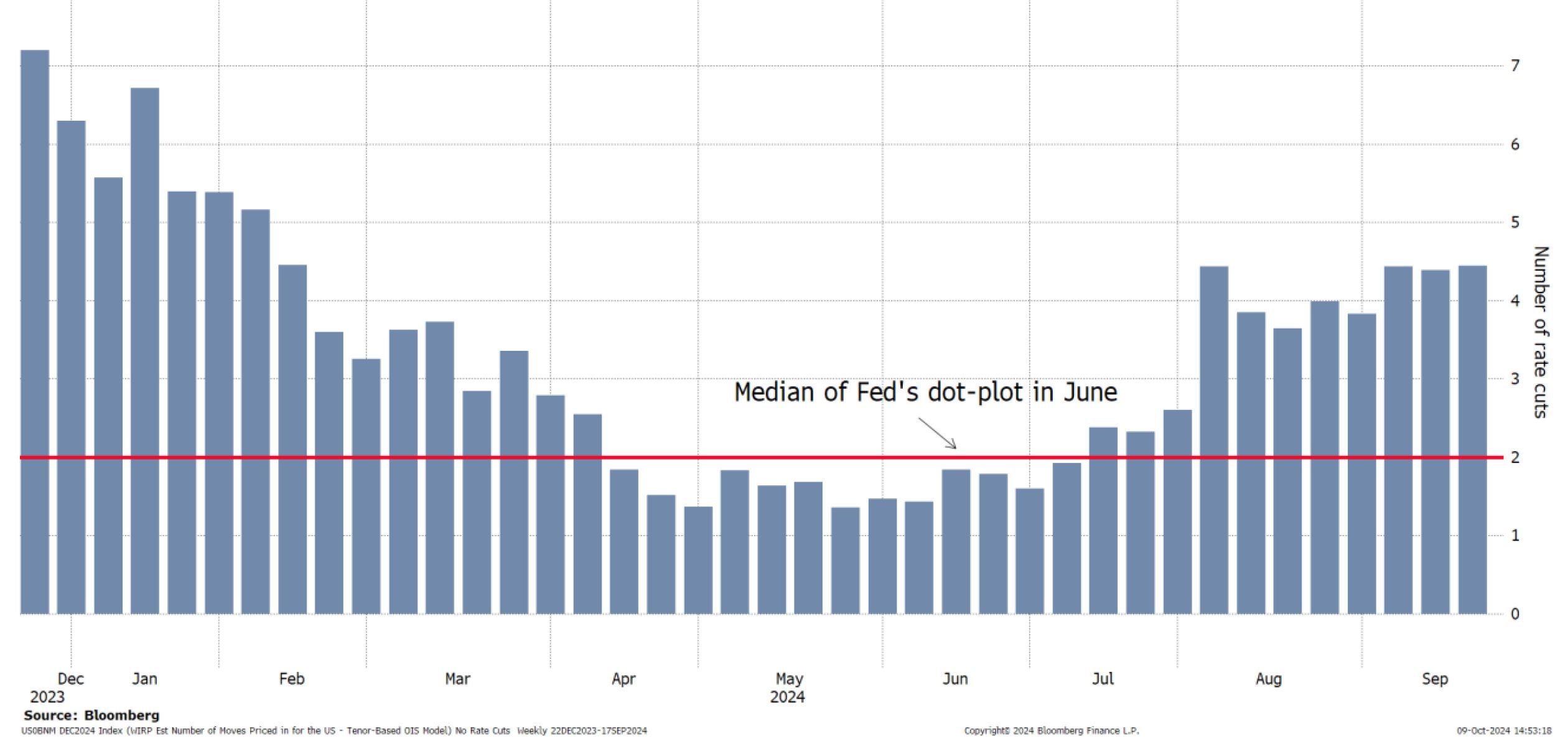

The Federal Open Market Committee (FOMC) has certainly changed their minds a few times over the past 3 quarters on how many 25-basis point (bp) rate cuts they project by the end of 2024. Market expectations at the beginning of the year were for 6 quarter-point cuts, then fell to less than 2 in the summer before rising again to around 4 cuts at the end of the third quarter.

Overnight Index Swap (OIS) Implied Number of Quarter-Point Rate Cuts by December

After 11 rate increases from March 2022 to July 2023 and over a year pausing, the FOMC decided to cut the federal funds rate by 50 basis points following the conclusion of their September meeting. The market was anticipating around a 40% chance of a 25 bp cut and a 60% chance of a 50 bp cut a day before the announcement. Interestingly, Fed Governor Michelle Bowman cast a single dissenting vote for a 25 bp cut – the first dissent by a Fed governor since 2005.

The new target range declined from 5.25%-5.50% to 4.75%-5.00%. The Fed now projects that the federal funds rate will be in the target range of 4.25%-4.50% at the end of 2024, implying another 50 basis points of cuts over the next 2 FOMC meetings. They project a further 100 basis points of cuts in 2025, taking the range to 3.25%-3.50% before ultimately hitting the terminal rate of 2.75%-3.00% in 2026. This 3% target is the “neutral” fed funds rate, which in theory is neither stimulative nor restrictive for economic growth. Bear in mind that Fed Chair Jerome Powell indicated in July that a 50-basis point rate cut was not in consideration for September, reminding us that these targets are dynamic and subject to change as new economic data is published.

In fact, a mere two weeks before the September 18th/19th Fed meeting, the market odds of a 50 bp rate cut were closer to 25%. Fed Governor Waller on September 6th commented on the balancing act between aggressively cutting rates versus a slow and steady rate cut cycle: “Determining the appropriate pace at which to reduce policy restrictiveness will be challenging. Choosing a slower pace of rate cuts gives time to gradually assess whether the neutral rate has in fact risen, but at the risk of moving too slowly and putting the labor market at risk. Cutting the policy rate at a faster pace means a greater likelihood of achieving a soft landing but at the risk of overshooting on rate cuts if the neutral rate has in fact risen above its pre-pandemic level. This would cause an undesired loosening of monetary policy.”

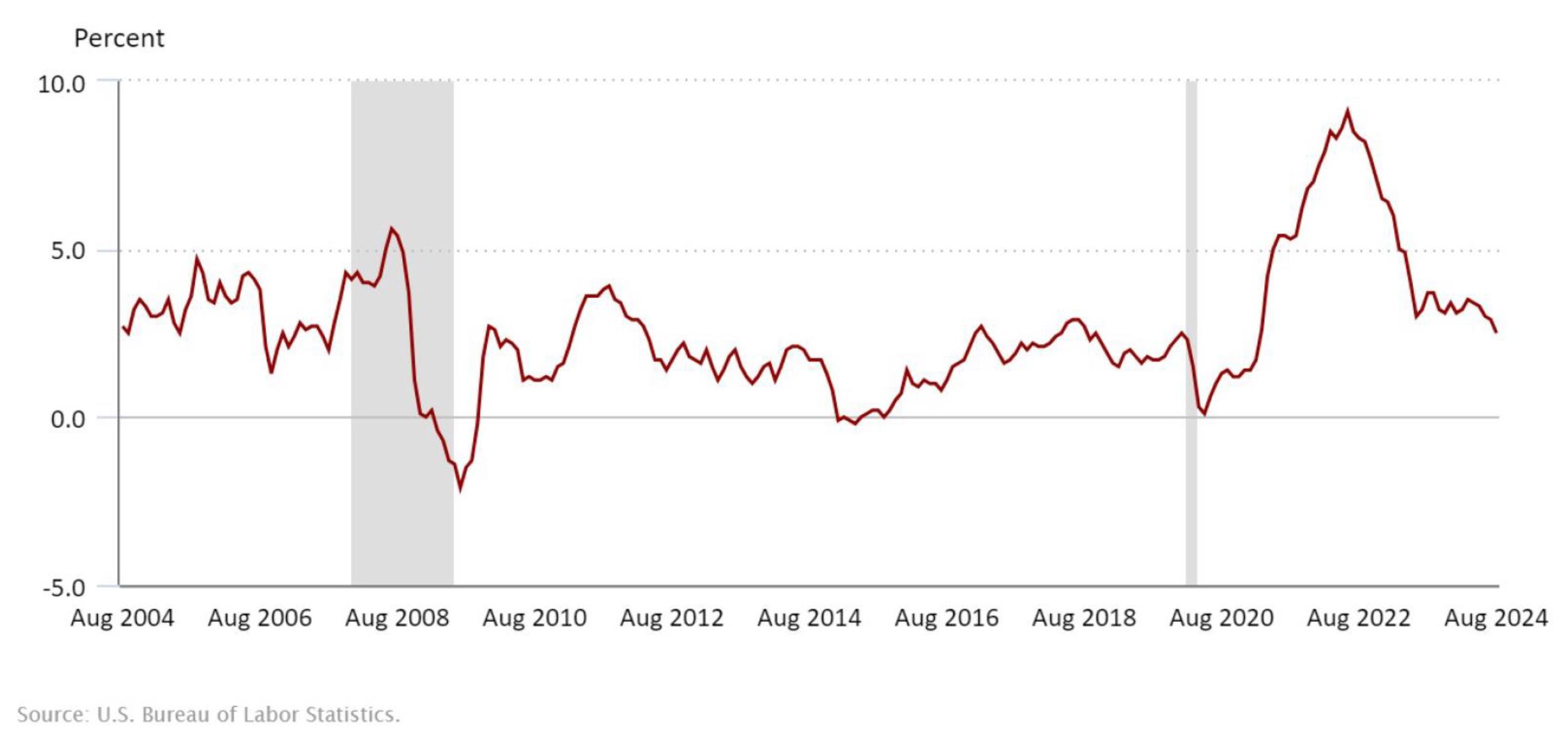

The Fed also adjusted their forecasts for Gross Domestic Product (GDP) (2% vs 2.1%), unemployment (4.4% vs 4%), and Personal Consumption Expenditures or PCE inflation (2.6% vs 2.8%) by the end of the year. Powell described the economy as “strong overall” and labor market conditions as “solid, having cooled from their previous overheated state”. On inflation, Powell said “inflation has eased, and my FOMC colleagues and I have greater confidence that it is on a sustainable path to 2 percent.” Many Wall Street analysts are skeptical that inflation will get as low as 2%, but significant progress has been made as indicated by the following chart.

Consumer Price Index – 12-month Percentage Change (not seasonally adjusted)

Equity markets continued to deliver strong performance in the quarter – the S&P 500 was up 5.9%, bringing the total return for the year through September 30th to 22.1%. As anticipated, market strength broadened beyond the Magnificent 7* as the S&P 500 Equal Weight Index was up 9.6% in the quarter, outpacing the market-cap weighted index by 3.7%. The Dow Jones Industrial Index was up 8.7% in the quarter and 13.9% for the year including dividends.

In addition to equity indices, the Bloomberg US Treasury Index had a positive return of 4.7% in the quarter. Two-year Treasury yields dropped from 4.8% to 3.6% and 10-year yields dropped from 4.4% to 3.8%. Gold also hit an all-time high.

The quarter wasn’t without volatility, however. As of September 30th, the S&P 500 closed at plus or minus 1% or greater on 41 trading days in 2024. Nearly half, or 20, of those 1% or greater moves fell in the third quarter, including the biggest selloff of the year on August 5th when the index fell 3%. The large decline was driven by a combination of a Japanese Yen carry-trade being unwound with attendant margin calls, a weak July jobs report and a rise of 0.2% in the unemployment rate.

After the selloff, Dr. Edward Yardeni shared his opinion that, “the selling pressure was not fundamentally driven but driven by overleveraged investors’ need to meet margin calls…In our opinion, the nonfarm payroll report was unduly weak owing to Hurricane Beryl, and employment indicators would rebound in the coming weeks.” Investors who bought the dip were rewarded as the S&P finished over 11% higher from the close on August 5th to the end of September. October 4th’s favorable job growth data supports Yardeni’s positive viewpoint on economic fundamentals.

A new stimulus package introduced by the Chinese government on September 24th also sparked a strong rally in the Hang Seng Index. The index had a total return of 11.6% through September 23rd and finished the quarter up 29.2%. The stimulus package includes interest rate cuts, lower reserve requirement ratios which allow banks to lend more, and greater support for the property markets. The Chinese government is hoping the new stimulus will help China achieve their 5% GDP growth target by the end of the year. US companies with exposure to China also saw a slight bump in share price following the announcement.

Sounds like a whole lot of good news! Mark Zandi, Chief Economist at Moody’s Analytics, commented in late September that “this is among the best performing economies in my 35+ years as an economist. Economic growth is rip-roaring, with real GDP up 3% over the past year. Unemployment is low at near 4%…Inflation is fast closing in on the Fed’s 2% target…House prices have never been higher…Corporate profits are robust, and the stock market is hitting a record high on a seemingly daily basis…There are plenty of threats. But in my time as an economist, the economy has rarely looked better.” Pretty strong words.

Despite all the positive news and commentary, there are a few threats as pointed out in the quote above. New layers of uncertainty include heightened tensions in the Middle East, the hurricanes wreaking havoc and leaving areas of the US under water, rising consumer debt loads, the refinancing of commercial real estate burdens, and of course everyone’s favorite upcoming event: the election. The market has never been a fan of uncertainty, and we would expect to see continued volatility in the fourth quarter at least until November 5th.

We invite you all to reach out with any questions and to enjoy a colorful and bountiful fall season.

* Alphabet, Amazon, Apple, Meta, Microsoft, Nvidia and Tesla comprise the Magnificent Seven.

Securities noted above valued as of the market close on October 7, 2024:

Alphabet Inc. Cl A (GOOGL $162.98)

Amazon.com Inc. (AMZN $180.80)

Apple Inc. (AAPL $221.69)

Meta Platforms Inc. (META $584.78)

Microsoft Corp. (MSFT $409.54)

NVIDIA Corporation (NVDA $127.72)

Tesla Inc. (TSLA $240.83)

These summary/prices/quotes/statistics contained herein have been obtained from sources believed to be reliable but are not necessarily complete and cannot be guaranteed. Errors and omissions excepted.