View PDF Version of Newsletter

October 5, 2016

Robert Bingham, CFA, President and Chief Investment Officer

John Wright, Principal, Director of Research

“And if this road gets rocky… Just steady as we go”

– Dave Matthews Band lyrics

“Steady as we go” sums up our stance for both the just-completed third quarter and the just-beginning fourth quarter. The last three months are now behind us, but the consternation and market uncertainty remain. As a result, market volatility should continue to be expected as investor questions remain unanswered.

For instance, the initial market panic that greeted Great Britain’s vote to leave the European Union on June 23rd has been followed by strong rates of return in both London and most other world markets. The FTSE 100 Index which tracks the 100 largest companies traded on the London stock exchange gained 13.5% from June 24th through September 30th. That Index ended the third quarter within 3% of its 20 year high. Given the anxiety that followed Brexit, such a market reaction was very encouraging. Yet just what steps the UK and Europe will take to implement Brexit still remain unknown.

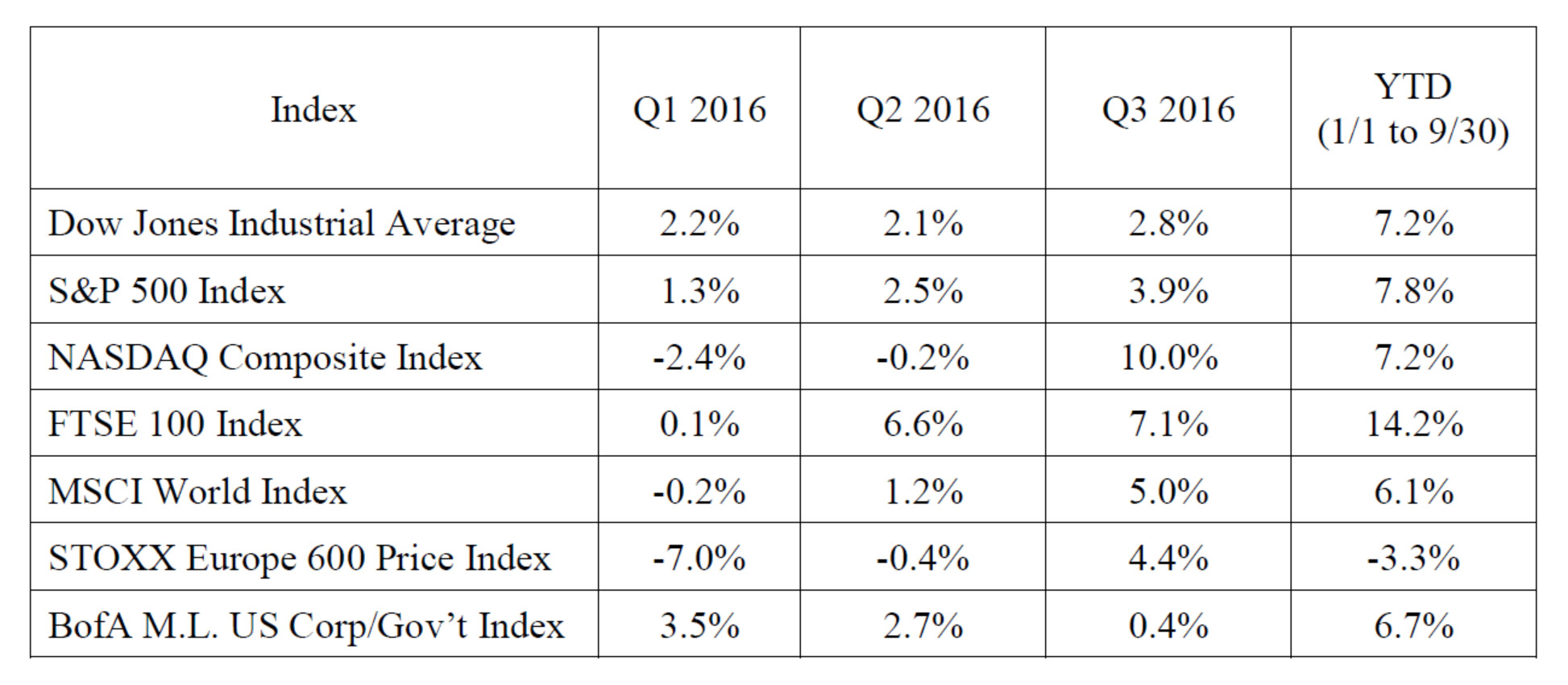

Similarly, the concern about weak earnings for American companies in the second quarter also proved overdone as the stock market had its best quarter of the year for the three months ending in September. Admittedly, corporate earnings in the United States are not growing rapidly, and the negative comparisons from second quarter results are expected to be seen again in the third quarter. FactSet currently predicts that earnings for the 500 S&P companies are likely to decline by 2.1% in this year’s third quarter when compared to last year’s third quarter. But this 2.1% decline is smaller than the projections made for quarters earlier this year – that is, earnings comparisons are getting better. Accordingly, the third quarter market returns as listed below were the strongest to date for 2016. (All figures below include the reinvestment of dividends and interest).

These results are notable given the ongoing questions about when the Federal Reserve may raise interest rates. September’s market weakness and volatility reflected investor concerns that the Federal Reserve might raise interest rates at its Open Market Committee meeting on September 21st. And since no action was taken at that meeting, investors will increasingly speculate on what decisions may be taken at the Federal Reserve’s next two meetings on November 2nd or on December 14th. The United States also holds national elections on November 8th. So, we should all expect the markets to bounce up and down this fall.

One area we continue to watch closely is the bond market. As noted in the previous table, the BofA Merrill Lynch US Corporate & Government Bond Index underperformed other indices in the third quarter. Even so, bonds still have provided good rates of return this year as interest rate levels have remained low throughout 2016 thus far. The yield curve for interest rates that reflects investor expectations has also continued to flatten out this year since investors do not expect any material changes to interest rate levels in the near term.

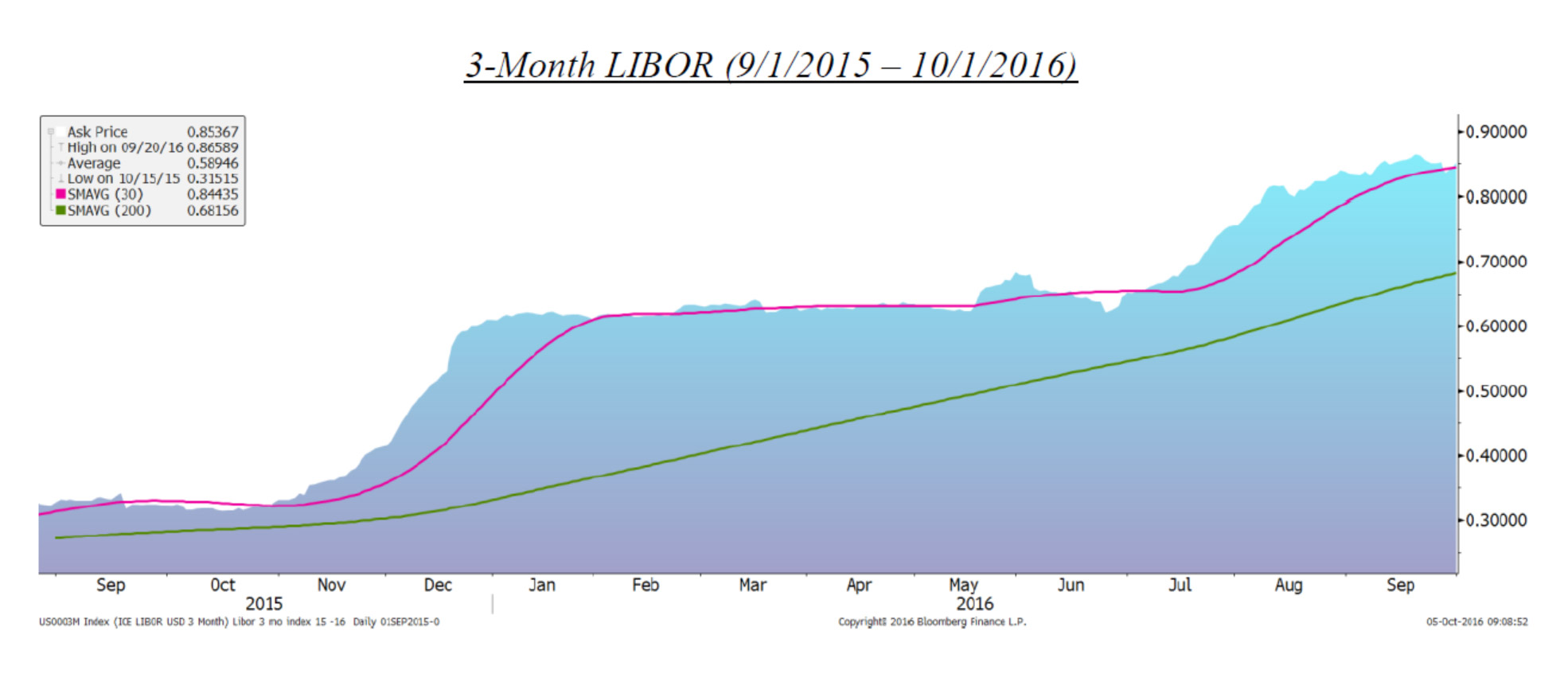

But as the following graph shows, LIBOR, or the London Interbank Offered Rate, has moved higher. This benchmark is typically used as the base lending rate for any loans or lines of credit that borrowers take down. LIBOR has become an international standard that is used by lenders to determine what level of interest rates should be charged on loans. As depicted in the chart, the LIBOR interest rate for 3 month loans increased to 0.85% on September 30th from 0.65% on June 30th. One year ago, on September 30, 2015, borrowers could borrow money for a three month period at the LIBOR base rate of 0.32%.

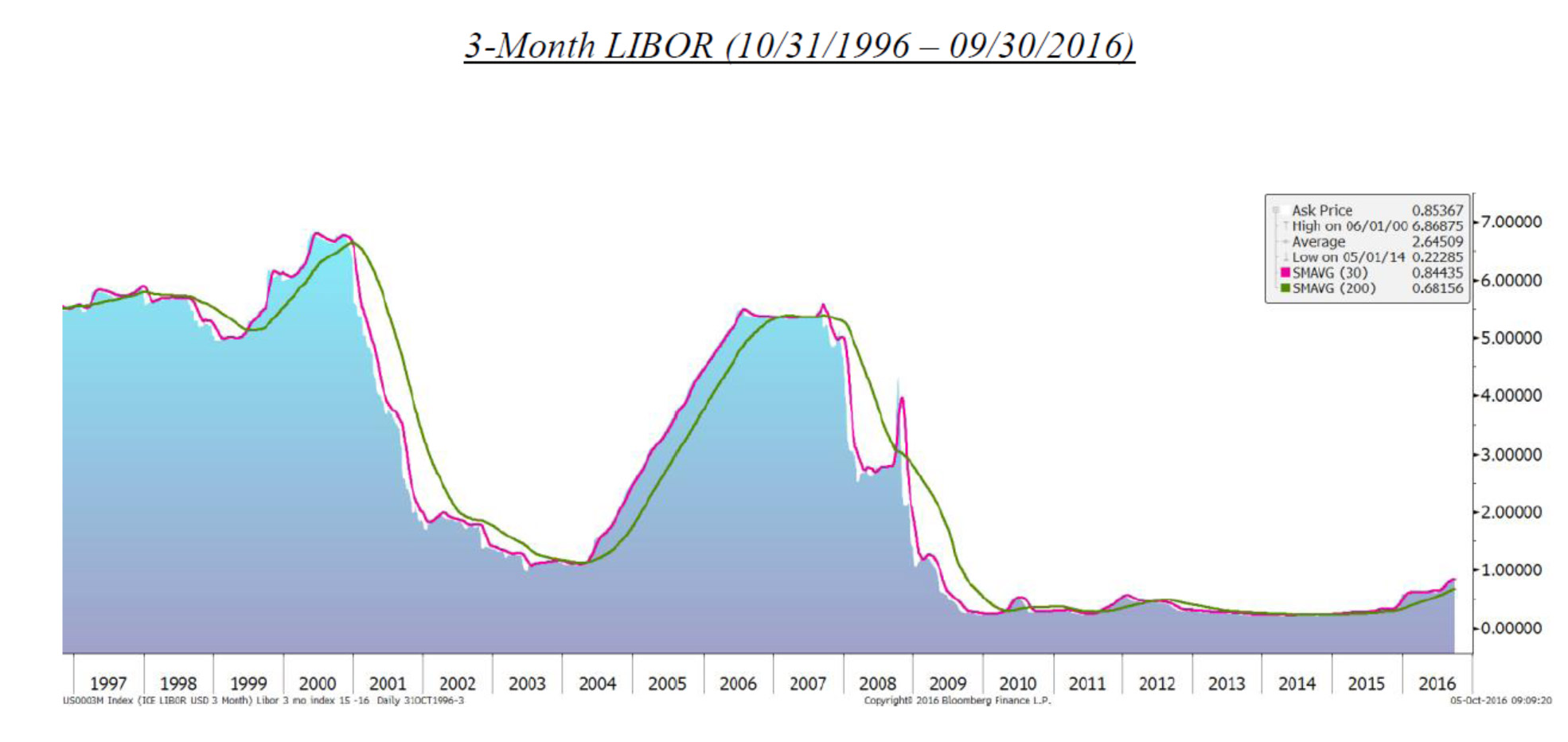

As seen on the graph below, the 3-Month LIBOR lending rate still remains materially lower than most of the previous rates seen during the last twenty years.

So, time will tell what changes will be seen in interest rates over the next few months and years. That said, the recent changes in LIBOR rates suggest that interest rates may have started to trend higher. Typically, that trend would be expected as economic growth increases and unemployment levels decline. Increases in inflation can also lead to higher interest rates. But to date, economic growth has been lackluster with a 1% inflation-adjusted growth rate seen for the first half of 2016 in the United States. The historical 2.1% average growth rate in gross domestic product since the recession of 2008/2009 has also been subpar.

Yet market consensus projections now estimate that this year’s third quarter growth rate may approximate 2.9% due to improving economic trends. Strong levels of consumer spending in the second quarter have led some companies to begin rebuilding inventories. Car sales have remained at historically high levels, and overall levels of manufacturing activity have modestly rebounded as was recently reported by the Institute for Supply Management on October 3rd.

Even the Federal Reserve has predicted that economic growth will be stronger in the second half of 2016 than the 1% rate seen in the first half of the year. Job growth has been the primary reason for the improving economic trends as national income levels have risen accordingly. If these wage gains continue, that will also increase the upward pressure on future rates of inflation. Interest rates may well increase a bit if these improving trends continue and job growth trends remain healthy.

Also on September 29th, PepsiCo released earnings earlier than expected with the best results they have posted in over ten years as measured on a per share basis. Like many companies, PepsiCo has been taking steps to improve its productivity which has increased its gross margins on product sales. Sales volumes were also strong with good trends being seen on both a product and geographic basis. Newer products like Pure Leaf tea, Naked Juice, and Propel electrolyte-enhanced water are also now contributing more to PepsiCo’s bottom line. Accordingly, for the second time in two quarters, PepsiCo has increased its earnings projections for 2016.

This month, we will have the chance to see how other companies’ earnings compare. As results are released, investors will better understand the strength of other companies’ prospects and earnings trends for the market. When combined with the release of more macroeconomic data, investors will build a better understanding for the fundamental strength of the United States’ economy.

Hopefully, these fundamental improvements will continue and still stronger economic growth trends will emerge. If so, the markets will become less concerned with just who may become America’s 45th President, and they will resume their historic focus on the economic growth of the country. Time will tell.

Do enjoy this fall season, and please let us know if you have any questions.

Securities noted above valued as of the market close on October 4, 2016:

PepsiCo, Inc. (PEP $107.10)

The above summary/prices/quotes/statistics contained herein have been obtained from sources believed to be reliable but are not necessarily complete and cannot be guaranteed. Errors and omissions excepted.