View PDF Version of Newsletter

January 7, 2025

Robert Bingham, CFA, President and Chief Investment Officer

John Wright, Principal

Jared Soper, Senior Portfolio Manager

Tyler Waterman, Portfolio Manager, Director of Research

“Even apart from the instability due to speculation, there is the instability due to the characteristic of human nature that a large proportion of our positive activities depend on spontaneous optimism rather than on a mathematical expectation, whether moral or hedonistic or economic.”

– John Maynard Keynes

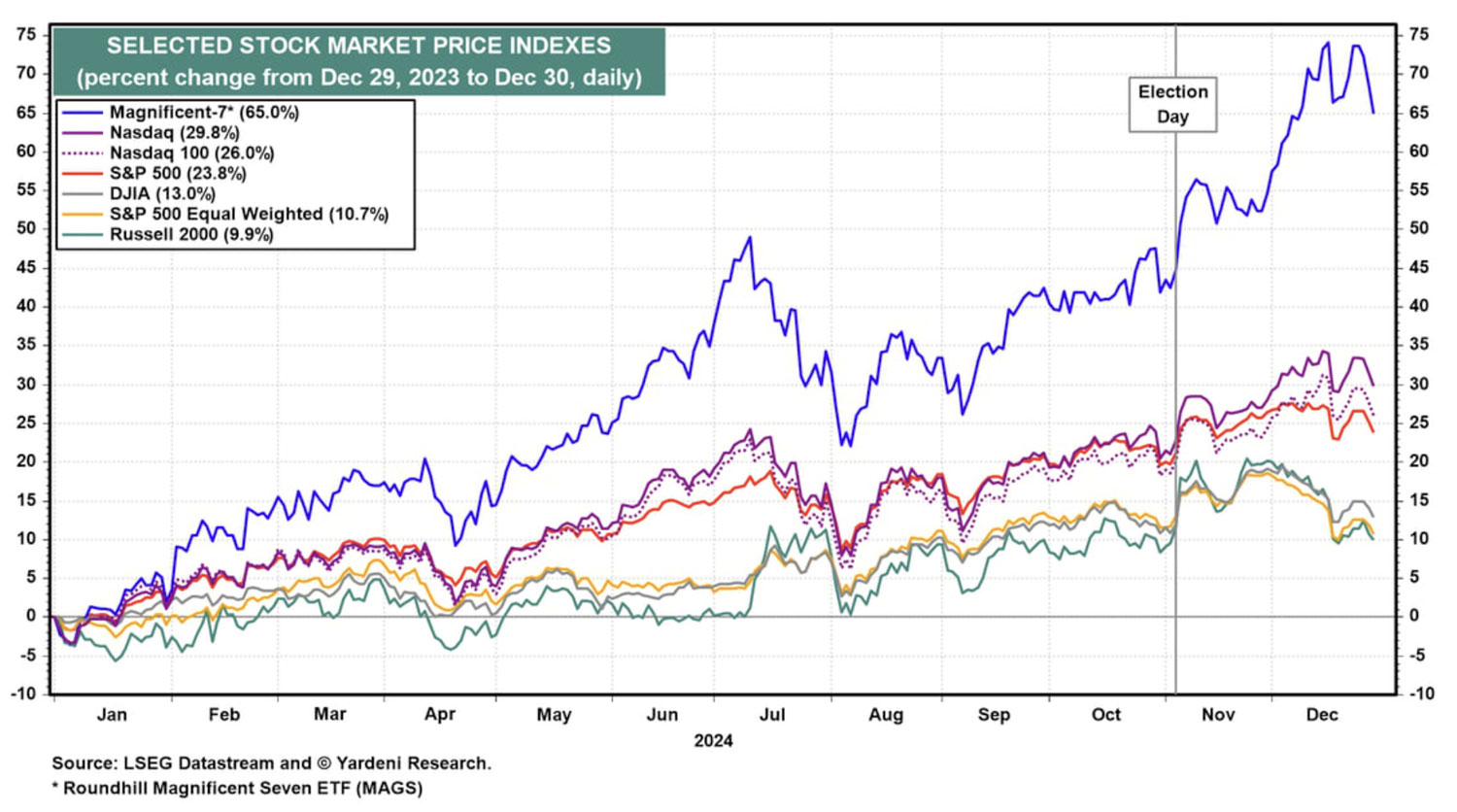

“Animal spirits” is a term coined by John Maynard Keynes to describe the tendency for human emotions to influence stock market gains and losses, rather than the intrinsic value of the underlying investment. The “fear of missing out,” or “FOMO,” is a state of mind that can lead investors to pile into high-momentum investments with recent outperformance. We saw this phenomenon occur in the fourth quarter as “risk-on” assets like the “Magnificent 7*” stocks, illustrated in the chart below, and cryptocurrencies, generated huge returns in the aftermath of the election. Investors are anticipating that policies from the incoming Trump administration, such as lower taxes and deregulation, will lead to continued market strength and earnings growth in 2025.

Of the stocks that comprise the Magnificent 7, none stood out more than Tesla in the fourth quarter, which saw its market capitalization increase 54% or nearly half a trillion dollars. Some investors may be expecting some form of quid pro quo for the hundreds of millions of dollars Tesla CEO Elon Musk poured into the 2024 election. The narrative has become more important than the underlying fundamentals, and whether we choose to call it animal spirits, irrational exuberance, FOMO, or spontaneous optimism – we believe this is a company that needs to significantly grow earnings over the next decade in order to justify its $1.3 trillion valuation and a forward price-to-earnings (P/E) multiple of 150. After becoming a close ally of President-elect Trump, and with a newfound position leading the Department of Government Efficiency (DOGE) alongside Vivek Ramaswamy, some investors have confidence that Musk has the power to meet these high expectations. Time will tell.

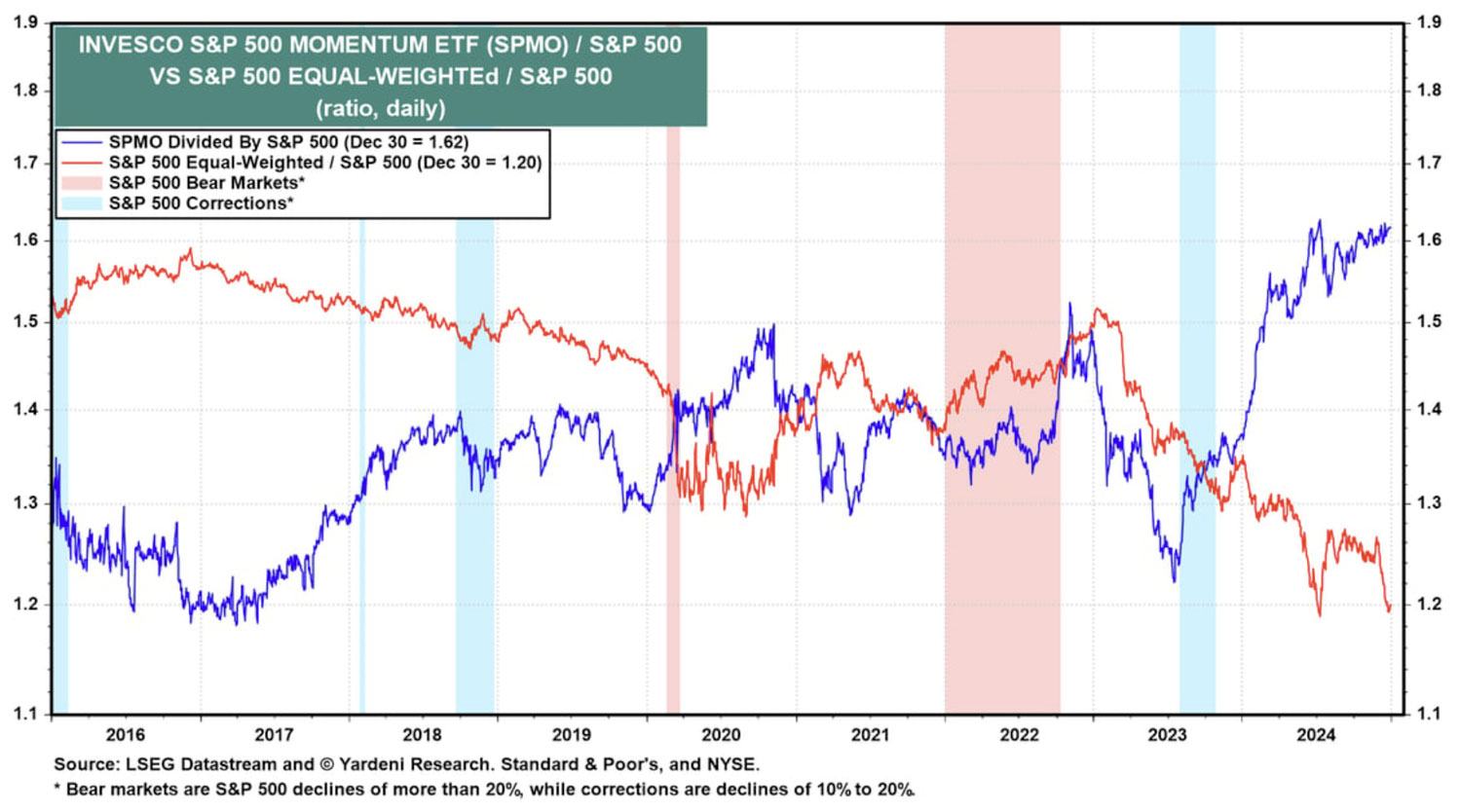

However high expectations and momentum are not unique to Tesla and the Magnificent 7. Take Palantir, for example, a technology company focused on providing software solutions to the intelligence community. Palantir was the top gainer in the S&P 500 last year, starting the year with a market capitalization of $38 billion and ending the year at over $170 billion. That’s a gain of over 340%, despite estimated earnings growth of 52% for 2024 and 25% for 2025. It now trades at a staggering price-to-sales ratio of around 63 and a forward P/E ratio of nearly 200. Palantir’s remarkable performance is a testament to the power of momentum in investing, a strategy that has significantly outperformed broader diversification over the past year and a half, as shown in the figure below.

We would be remiss if we did not mention that extended periods of positive stock momentum and earnings-multiple expansion may ultimately result in large, rapid drawdowns, such as the sell-off following the late 1990s Bull Market. In 2022, Meta Platforms, Netflix, and Tesla all saw declines in excess of 70% from their 2021 peak to their trough. Nvidia lost two thirds of its market cap and Amazon lost over half. Federal Reserve Governor Lisa Cook recently echoed the concern that valuations are elevated, stating, “markets may be priced to perfection and, therefore, susceptible to large declines, which could result from bad economic news or a change in investor sentiment.”

The S&P 500 index capped another strong year with a total return including dividends of +25.0%, nearly doubling the total return of the equal weight S&P 500 index, which came in at +13.0%. The Russell 2000 underperformed both indices at +11.5% while the Dow Jones fell in between at +15.0% total return. Gold and Bitcoin also had very strong years, advancing 26% and 121% respectively.

The yield on 2-year US Treasuries was 4.2% at the close of the year, down modestly from 4.3% to start the year and up from 3.6% at the end of the third quarter. The 10-year US Treasury bond yield increased from 4.1% at the start of 2024 and 3.8% at the end of the third quarter to 4.8%. 30-year mortgage rates remain elevated at around 7%, reflecting the increase in longer term interest rates.

Since the end of the third quarter, the Federal Open Market Committee (FOMC) has cut the federal funds rate (FFR) by an additional 50 basis points (bps) – a 25 basis point cut in November and a subsequent 25 basis point cut in December. This brings the total rate cut for the year to 100 bps, or a full percentage point, and has resulted in a new FFR target range of 4.25%-4.50%.

Both rate cuts were widely anticipated, but the S&P 500 declined nearly 3% following the announcement in December – its largest drop since August 5th. The decline was largely due to a change in forecasts for rate cut activity going forward. The median projection for rate cuts in 2025 now stands at two 25 basis point cuts, down from four projected at the September meeting.

At his December 18th press conference, Fed Chair Jerome Powell addressed the drivers of the slower rate cut path during the Q&A: “First thing is growth is stronger, right? The economy grew faster in the second half of 2024, so far, than we had expected, and is expected to be above our expectations in September next year as well. Unemployment is lower, and in the (Summary of Economic Projections), you’ll see that participants think that the downside risks are less and uncertainty is less at the end, so that’s more strength, right? Inflation is higher, as we talked about, inflation’s higher this year, it’s also higher in the forecast next year. I’d also point out that we’re closer to the neutral rate, which is another reason to be cautious about further moves.”

In a nutshell, further rate cuts are on hold until there is more certainty on the direction in which inflation is headed. That uncertainty is compounded by the fact that a new administration is set to begin implementing its policies in the upcoming weeks, having campaigned on a platform of widespread tariffs and mass deportations. These actions could be inflationary. When questioned on the role the upcoming administration’s policies played in FOMC forecasts, Powell said, “some did identify policy uncertainty as one of the reasons for their writing down more uncertainty around inflation,” and added, “we just don’t know really very much at all about the actual policies, so it’s very premature to try to make any kind of conclusion. We don’t know what’ll be tariffed from what countries, for how long, and what size. We don’t know whether there will be retaliatory tariffs, we don’t know what the transmission of any of that will be into consumer prices.”

Gross domestic product (GDP) was up an annualized 2.8% in the third quarter, in line with second quarter growth. Looking forward, the FOMC projects that GDP growth will remain solid, with a median projection of 2% over the next few years. They also anticipate 4.3% unemployment over that timeframe and 2.5% personal consumption expenditure (PCE) inflation in 2025. Factset consensus calls for S&P 500 earnings growth of 15% in 2025.

So what is helping drive predictions for strong earnings growth in US equities, outside the expected policy shift from the Trump administration? Many would point to the potential for continued productivity gains, a domain in which the US has long maintained a leading role, largely due to the success of US technology companies and more recently, artificial intelligence. In his article “The U.S. Needs a Productivity Miracle. It Might Just Get One,” Wall Street Journal author Aaron Back wrote, “When productivity is booming, it allows the economy to expand faster without triggering inflation.” He further noted, “Preliminary estimates from the Bureau of Labor Statistics show that total nonfarm business sector labor productivity increased 2.0% from a year earlier in the third quarter – the fifth straight quarter of growth at or above 2%. That is significant as the average rate of growth for the five years before the pandemic was 1.6%.” We see this trend continuing and accelerating as US companies continue to invest in AI and automation.

Investment strategist Ed Yardeni shares a similar view, assigning a 55% probability that the US enters a bullish, “Roaring 2020s” scenario, with rapid growth in the latter half of the decade driven in part by productivity improvements. Yardeni commented in December that, “we are expecting productivity growth to accelerate toward 3.0%-3.5% over the rest of this decade, driving real GDP higher even as a slowdown in labor force growth causes hours worked to increase only marginally.” Yardeni has compared the present environment to periods before prior productivity peaks in the 1950s (interstate highway buildout), 1960s (mainframes), and the late 1990s (internet/PCs).

We’ve seen companies such as Coca-Cola and Toys ‘R’ Us experiment with generative artificial intelligence (GenAI) in marketing this year with a reasonable degree of success. The use of GenAI allowed these companies to produce ad campaigns at a lower cost and reduced their time to market. Artificial intelligence has also been used to reduce labor costs and/or improve outcomes in areas such as customer service, cybersecurity and drug discovery. There is certainly more to come.

As 2025 begins, we remain cautiously optimistic about this year’s prospects. Earnings trends seem encouraging, productivity gains should continue, and stock valuations may hold up if corporate earnings materialize as expected. However, uncertainties are always with us, and inflation trends need to decline. Certainly, the California wildfires, rising insurance costs, and wars remain current concerns. Rich stock valuations could be vulnerable to negative surprises.

At SKY, we’ll continue to embrace diversification to offset surprises and prospective risks. We’ll continue to focus on an investment’s intrinsic value and to assess the outstanding risks and opportunities. While it’s unlikely that the S&P will appreciate by another 20% this year, we believe investors should feel comfortable staying invested for the long term.

As always, we value your trust and confidence in SKY Investment Group and are committed to support you in any way we can. Please let us know if you have any questions or would like to visit.

* Alphabet, Amazon, Apple, Meta, Microsoft, Nvidia and Tesla comprise the Magnificent 7.

Securities noted above valued as of the market close on January 6, 2024:

Alphabet Inc. Cl A (GOOGL $196.87)

Amazon.com Inc. (AMZN $227.61)

Apple Inc. (AAPL $245.00)

The Coca-Cola Company (KO $60.81)

Meta Platforms Inc. (META $630.20)

Microsoft Corp. (MSFT $427.85)

NVIDIA Corporation (NVDA $149.43)

Palantir Technologies Inc. (PLTR $75.92)

Tesla Inc. (TSLA $411.05)

These summary/prices/quotes/statistics contained herein have been obtained from sources believed to be reliable but are not necessarily complete and cannot be guaranteed. Errors and omissions excepted.