View PDF Version of Newsletter

April 10, 2025

Robert Bingham, CFA, President and Chief Investment Officer

John Wright, Principal, Senior Portfolio Manager

Jared Soper, Senior Portfolio Manager

Tyler Waterman, Director of Research, Portfolio Manager

“As soon as you realize you can afford to wait out any correction, the calamity also becomes an opportunity to pick up bargains.”

– Peter Lynch, former manager of Fidelity’s Magellan Fund

In our prior quarterly commentary, we pointed to extremely elevated valuations in a number of high-momentum, high-growth stocks due to increasing optimism in the market following the 2024 election. Promises of lower taxes and deregulation have quickly become overshadowed by an increasing probability that the US will experience a global trade war and a recession.

Strategist Ed Yardeni increased his predicted likelihood of a recession/stagflation scenario playing out from 20% to 45% over the course of the quarter, in part due to the large degree of uncertainty caused by recent tariff announcements. Large financial institutions also increased the probability of a recession hitting the US: JP Morgan from 40% to 60%, Goldman Sachs from 20% to 35%, S&P Global from 25% to 30-35%, and Moody’s from 15% to 40%. As of April 8th, the expected probability of a recession had risen to 42.5% from 24% earlier in the year.

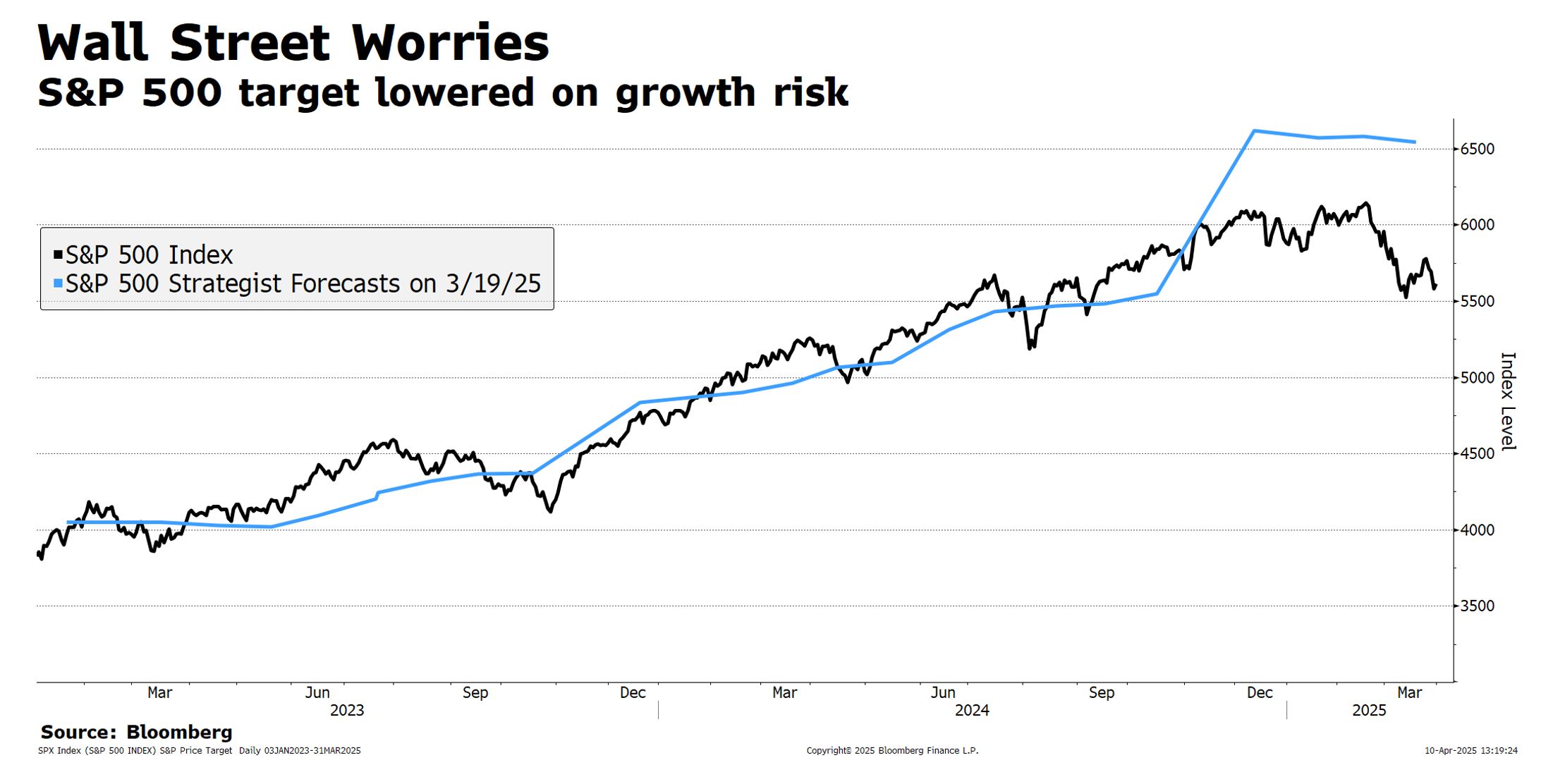

Unsurprisingly, Wall Street strategists’ year-end estimates for the S&P 500, shown in the table below, also declined throughout the quarter from a peak of 6,614 in December. We would expect estimates to be lower in mid-April when the next set of data is released.

The S&P 500 Index fell 4.3% during the first quarter of 2025 when including dividends. The index briefly touched correction territory over the course of the quarter, defined as a decline of 10% or greater from recent highs, but not exceeding 20%. The decline was largely led by Magnificent 7* stocks and other high-momentum constituents. The Equal-Weight S&P Index fared better, falling 0.6% during the same period when including dividends.

This trend was more pronounced in the tech-heavy Nasdaq Composite Index and Russell 2000 Index, which saw total returns of -10.3% and -9.5% respectively as investors rotated into more defensive positions. Bonds outperformed during the first quarter as the yield on the 10-year Treasury fell from 4.6% to 4.2%. Gold was up 19% while Bitcoin fell 11.7%.

No more than one week after the end of the first quarter, we find ourselves digesting major tariff announcements that make the happenings of the prior three months seem almost irrelevant. After the market close on April 2nd, President Donald Trump revealed his plans for improving trade imbalances between the United States and international trading partners via reciprocal tariffs on imports coming into this country.

While there had been rumors from White House aides leading up to the announcement that tariffs could be capped at 20%, the reality proved far more severe. A 10% minimum tariff, set to go into effect on April 5th, was applied to every country across the board. However, many countries found themselves hit by tariffs that were far greater than even the most pessimistic of expectations. Noteworthy reciprocal tariffs include China at 34% (on top of previously announced 20% tariffs earlier in the year), the European Union at 20%, Taiwan at 32%, and Vietnam at 46%. The announcement on April 2nd was in addition to a 25% tariff that had been placed on Canadian and Mexican imports earlier in the year, a 25% tariff on aluminum and steel imports, and a 25% tariff on automobile imports.

Dan Ives, Wedbush global head of technology research, tweeted “We would characterize this slate of tariffs as ‘worse than the worst-case scenario’ the Street was fearing. The biggest focus will be the China 34% tariff and Taiwan 32% and how this impacts supply chain and demand. Negotiations [are] the only option at this point for White House.” Mr. Ives joins a chorus of analysts decrying the audaciousness of the new tariffs and warning that the US is in for much more economic pain if they persist for the long term.

The methodology used to calculate the long list of reciprocal tariffs remains somewhat of a mystery. The tariffs seem to be partially based on the overall trade deficit the US has with other countries, rather than a response to the tariffs those countries have implemented. For instance, President Trump’s list revealed that Vietnam is currently charging 90% tariffs on US exports, but none of their tariffs come close to that number. The 90% is more likely to represent the trade deficit, as Vietnam imported $13.1 billion of goods from the US in 2024 versus $136.6 billion exported. The $123.5 billion deficit is approximately 90% of $136.6 billion. Non-tariff barriers were also taken into consideration, such as Australia forbidding the purchase of US beef.

One of the stated goals of the Trump administration’s trade policy is to re-ignite domestic manufacturing and bring more production facilities onshore. In his April 2nd speech, coined “Liberation Day,” President Trump highlighted some of the large commitments companies had made to build plants and expand manufacturing capacity in the United States. He noted that, “Apple is going to spend 500 billion dollars…They’re going to build their plants here. SoftBank, OpenAI and Oracle… are investing 500 billion dollars almost immediately. Nvidia… is investing hundreds of billions of dollars they just announced. TSMC… is investing 200 billion.”

If companies choose not to bring manufacturing onshore, they may be stuck paying hefty tariffs to continue importing goods. President Trump also sees this as a win, because the tariffs would generate revenue for the US government. This additional revenue could be used to decrease the budget deficit. Even at the baseline 10% level, if total goods imports were to remain around the current $3.3 trillion level, that would equal roughly $330 billion of revenue. The chart below highlights some of the US’s largest trading partners and the dollar value of imports entering our country.

On the other hand, if companies are forced to pay higher prices for imports, there is a high probability that they will attempt to pass those higher costs on to consumers. This would lead to higher inflation, which when coupled with lower economic growth from reduced trade and investment, could lead to stagflation. This sentiment was echoed recently by Fed Chair Jerome Powell at a conference: “While uncertainty remains elevated, it is now becoming clear that the tariff increases will be significantly larger than expected. The same is likely to be true of the economic effects, which will include higher inflation and slower growth.”

President Trump has indicated on several occasions that he wants Jerome Powell’s Fed to cut interest rates, though that seems unlikely given the most recent strong jobs report and ongoing inflation rates. However, that data reflect the state of the economy before tariffs went into effect. If restrictive tariffs lead to a US recession, that could pave the way for interest rate cuts.

The government’s attempts to reduce the $36.2 trillion national debt have been a two-pronged attack. While the freshly-announced tariffs are focused on increasing revenue, Elon Musk and his Department of Government Efficiency (DOGE) have focused on reducing government waste and spending.

According to the DOGE website, approximately $140 billion in savings have been realized thus far through their cost-cutting efforts. The website contains a “wall of receipts” that tabulate all of the cuts to government contracts, grants, and leases. Unfortunately, these receipts only make up about 30% of the $140 billion figure, so it is unclear where the bulk of the savings comes from. Other categories for savings include asset sales, interest savings, programmatic changes, regulatory savings and workforce reductions.

Critics of Elon Musk and DOGE have been quick to identify errors and overstatements of some savings figures. For instance, there have been times when the ceiling value of an indefinite delivery/indefinite quantity (IDIQ) contract was reported as savings, even though the actual spending was well below the ceiling amount. This would be similar to canceling a credit card with a $10,000 credit limit, but with only $1,000 of current debt outstanding and calling it $10,000 in savings. Mr. Musk has admitted that he will make mistakes and “nobody’s going to bat a thousand.”

Market volatility will likely persist, but it should moderate over time. Strong management teams should be expected to strategically re-align their businesses to adapt to the new paradigm. Apple’s decision to temporarily replace imports from China with product from India is an example of such a shift.

In the face of heightened volatility, our mantra remains the same: Buy high-quality companies when they are attractively priced. The sharp downturn since the beginning of the second quarter made valuations that much more attractive than at quarter end. Corporations will also release earnings for the first quarter and guidance for the balance of the year, giving us the opportunity to re-evaluate earnings growth, cash flows and the likelihood of a recession.

Do please let us know if you would like to meet with us in person or speak with us directly.

* Alphabet, Amazon, Apple, Meta, Microsoft, Nvidia and Tesla comprise the Magnificent 7.

Securities noted above valued as of the market close on April 9, 2025:

Alphabet Inc. Cl A (GOOGL $158.71)

Amazon.com Inc. (AMZN $191.10)

Apple Inc. (AAPL $198.85)

The Goldman Sachs Group, Incl (GS $516.87)

JPMorgan Chase & Co. (JPM $234.34)

Meta Platforms Inc. (META $585.77)

Microsoft Corp. (MSFT $390.49)

Moody’s Corporation (MCO $438.59)

NVIDIA Corporation (NVDA $114.33

Oracle Corporation (ORCL $139.69)

S&P Global Inc. (SPGI $473.99)

SoftBank Corp.- ADR (SOBKY $14.16)

Taiwan Semiconductor Manufacturing Company, Ltd. (TSM $158.75)

Tesla Inc. (TSLA $272.20)

These summary/prices/quotes/statistics contained herein have been obtained from sources believed to be reliable but are not necessarily complete and cannot be guaranteed. Errors and omissions excepted.