Third Quarter 2025 Review and Commentary

October 9, 2025

Robert Bingham, CFA, President and Chief Investment Officer

John Wright, Principal, Senior Portfolio Manager

Jared Soper, Senior Portfolio Manager

Tyler Waterman, Director of Research, Portfolio Manager

“Bull markets are born on pessimism, grow on skepticism, mature on optimism and die on euphoria.”

– Sir John Templeton

Equity markets continued their hot streak following the Liberation Day-fueled April selloff to set new record highs in the month of September. The S&P 500 finished the quarter up 8.1% including dividends, bringing the total return for the year through September 30th to +14.8%. Even more impressive in the third quarter was the performance of the Nasdaq Composite and Russell 2000 Index, which saw total returns of +11.4% and +12.4% respectively. Gains were driven by lower interest rates and strong company earnings, as over 80% of S&P 500 constituents beat estimates.

The Russell 2000, which is composed of smaller companies, saw a strong recovery after a negative total return through the end of the second quarter, indicating that market strength may be broadening out beyond technology companies tied to AI investments. Nevertheless, one of the dominant narratives of the quarter was the ongoing surge in investor enthusiasm for artificial intelligence and related infrastructure stocks, which also had outsized gains.

The rapid market ascent has led many analysts to call into question how sustainable these market returns will be going forward. There has been no shortage of commentary that equity valuations appear stretched and AI participants may be approaching bubble territory, with some even comparing the current environment to the infamous “dot com bubble” in 2000.

Amazon founder Jeff Bezos, when asked if there were signs that the current AI industry is in a bubble, responded that, “this is a kind of industrial bubble”, but added that the technology is “real, and it is going to change every industry.” He went on to note that one of the hallmarks of a bubble is that people get really excited, “and investors have a hard time in the middle of this excitement, distinguishing between the good ideas and the bad ideas. And that’s probably also happening today.”

Nvidia CEO Jensen Huang weighed in on the comparisons to the “dot com bubble” during a CNBC interview. Mr. Huang observed that, “what’s going on in the world versus what happened in 2000 is dramatically different.” He added, “if you look at hyperscalers now, that’s where the first tranche of AI infrastructure is building…that’s $2.5 trillion of business already operating today…the [capital expenditure] that goes underneath that…call it about $500 billion, that transition from a classical CPU-based computing to now generative AI computing, powered by GPUs, that transition is just starting.”

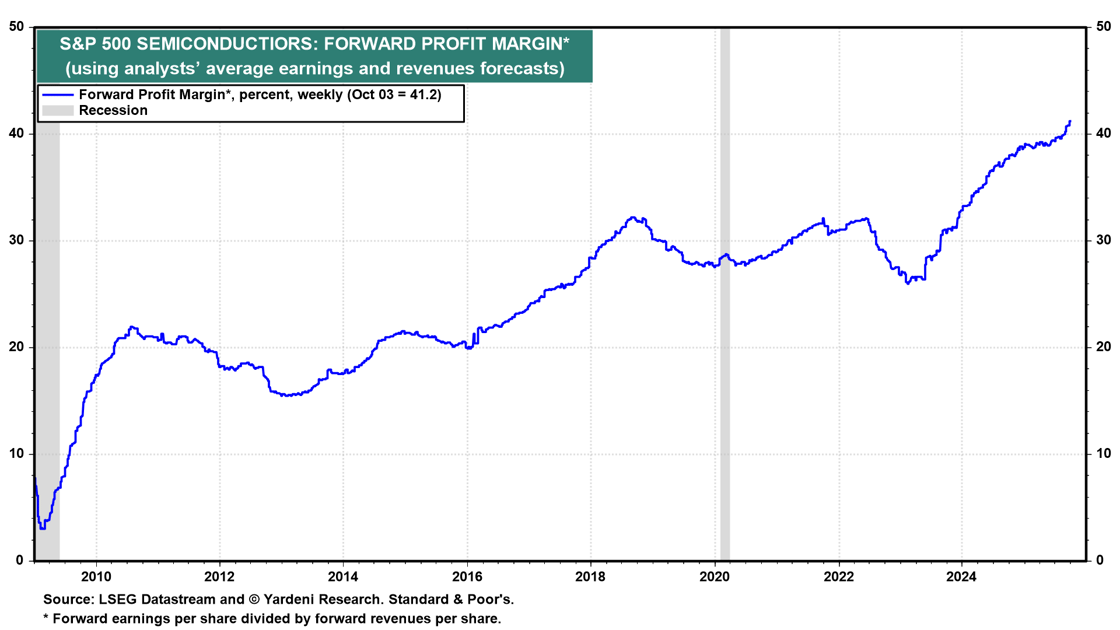

We believe Jensen Huang is correct to note that comparisons of today’s market to the “dot com bubble” appear to be apples to oranges. Many companies that participated in the melt up preceding the 2000 crash were unprofitable, unlike cloud service providers (Amazon, Microsoft, and Google) and semiconductor companies driving the market higher this year, which are highly profitable. While price-to-earnings multiples and other valuation metrics have certainly moved higher, there is a strong argument to be made that the moves are justified by the growth in semiconductor sales and margins seen in the charts below.

AI company valuations aren’t the only market activity raising eyebrows. OpenAI, the artificial intelligence company well-known for the popular large language model ChatGPT, also made headlines multiple times during of the quarter. New and expanded partnerships with technology companies Broadcom, Oracle, and CoreWeave were revealed as OpenAI continues to invest heavily in data center infrastructure.

OpenAI has committed $10 billion to Broadcom for the development of custom AI accelerator chips, a staggering $300 billion to Oracle for cloud computing power, and an additional $6.3 billion to CoreWeave to help train OpenAI’s next-generation models. In October, OpenAI also announced a partnership with Advanced Micro Devices (AMD) to buy the latest version of AMD’s high performance graphic processing unit (GPU), starting next year. As a part of the deal, OpenAI was issued a warrant for up to 160 million shares of AMD, or 10% ownership, to further align strategic interests.

These large commitments from OpenAI beg the question: How is all of this going to be financed? OpenAI is currently valued at around $500 billion and their annualized recurring revenue as of July was $12 billion. The company is currently unprofitable but growing and building scale at a tremendous pace. Despite this strong growth, OpenAI does not expect to be cash flow positive until the end of the decade. Therefore, OpenAI needs to raise significant capital from outside sources.

On September 25th, Nvidia, the $4.5 trillion chipmaker, announced that they intend to invest up to $100 billion in OpenAI to support the deployment of at least 10 gigawatts of AI data centers with Nvidia systems. This arrangement and others like it have raised concerns that these deals are circular in nature. In this scenario, Nvidia gives money to OpenAI for an equity stake, then OpenAI turns around and uses a portion of the funds to purchase hardware from Nvidia. Another portion of funds may be used by OpenAI to purchase cloud computing from Oracle, who will then buy additional GPUs from Nvidia. Also noteworthy: both Nvidia and OpenAI have equity stakes in CoreWeave, who is providing AI infrastructure to OpenAI and buys chips from Nvidia.

Acknowledgement and discussion of risks in the market is nothing new – stock valuations, inflation levels, tariff and trade policies, geopolitical turmoil, labor market softness, and most recently the U.S. Government shutdown have all contributed to the list of concerns for 2025. The healthy presence of pessimism often indicates that markets still have upside, supported by continued corporate earnings momentum, productivity gains, and declining interest rates.

On September 17, the Federal Reserve cut interest rates for the first time since December of last year, lowering the federal funds rate by 25 basis points (bps) to a target range of 4.00% to 4.25%. The move was largely anticipated and priced in by markets as treasury bond yields drifted higher in the days following the announcement. Expectations now reflect an additional 50 bps of interest rate cuts through the end of this year.

Once again, Federal Reserve Chair Jerome Powell highlighted the importance of the Fed’s dual mandate goals of maximum employment and low inflation at his press conference. He commented that, “while the unemployment rate remains low, it has edged up, job gains have slowed, and downside risks to employment have risen. At the same time, inflation has risen recently and remains somewhat elevated.”

Encouragingly, the median expectation from the Summary of Economic Projections projects gross domestic product (GDP) growth to accelerate slightly from 1.6% in 2025 to 1.8% in 2026, though these projections fall well below the 2.5% GDP growth we saw in 2024. The recent AI investment activity has certainly helped support the growth in GDP and some have projected third quarter GDP to exceed 3%.

Though the quarter began with the passage of the One Big Beautiful Bill Act and ended with a government shutdown, companies have continued to grow earnings and invest in their future. While a market correction is possible, it is not assured. For this reason, we believe it is important to stay invested, diversify your holdings, and be prepared to take advantage of market weakness.

Securities noted above valued as of the market close on October 8, 2025:

Advanced Micro Devices, Inc. (AMD $235.56) Alphabet Inc. Class C (GOOG $245.46)

Amazon.com, Inc. (AMZN $225.22) Broadcom Inc. (AVGO $345.50)

CoreWeave, Inc. (CRWV $139.98) Microsoft Corporation (MSFT $524.85)

NVIDIA Corporation (NVDA $189.11) Oracle Corporation (ORCL $288.63)

These summary/prices/quotes/statistics contained herein have been obtained from sources believed to be reliable but are not necessarily complete and cannot be guaranteed. Errors and omissions excepted.

This is not a general recommendation to buy or sell any particular security. Such advice is given to each of our clients individually based on their particular financial goals and objectives, risk tolerance and investment experience. For advice regarding your individual portfolio, please contact your investment manager. The information displayed here is limited to the dissemination of general information on products and services and transactions cannot be completed via this website.

The charts included in this report are sourced from Yardeni Research.