Equity Management Philosophy

Our approach to managing equity portfolios is based on the premise that the ultimate driver of share price appreciation is a company’s underlying earnings growth. Our objective is to acquire companies when they are selling below their intrinsic value and to allow the underlying earnings growth to drive share prices higher.

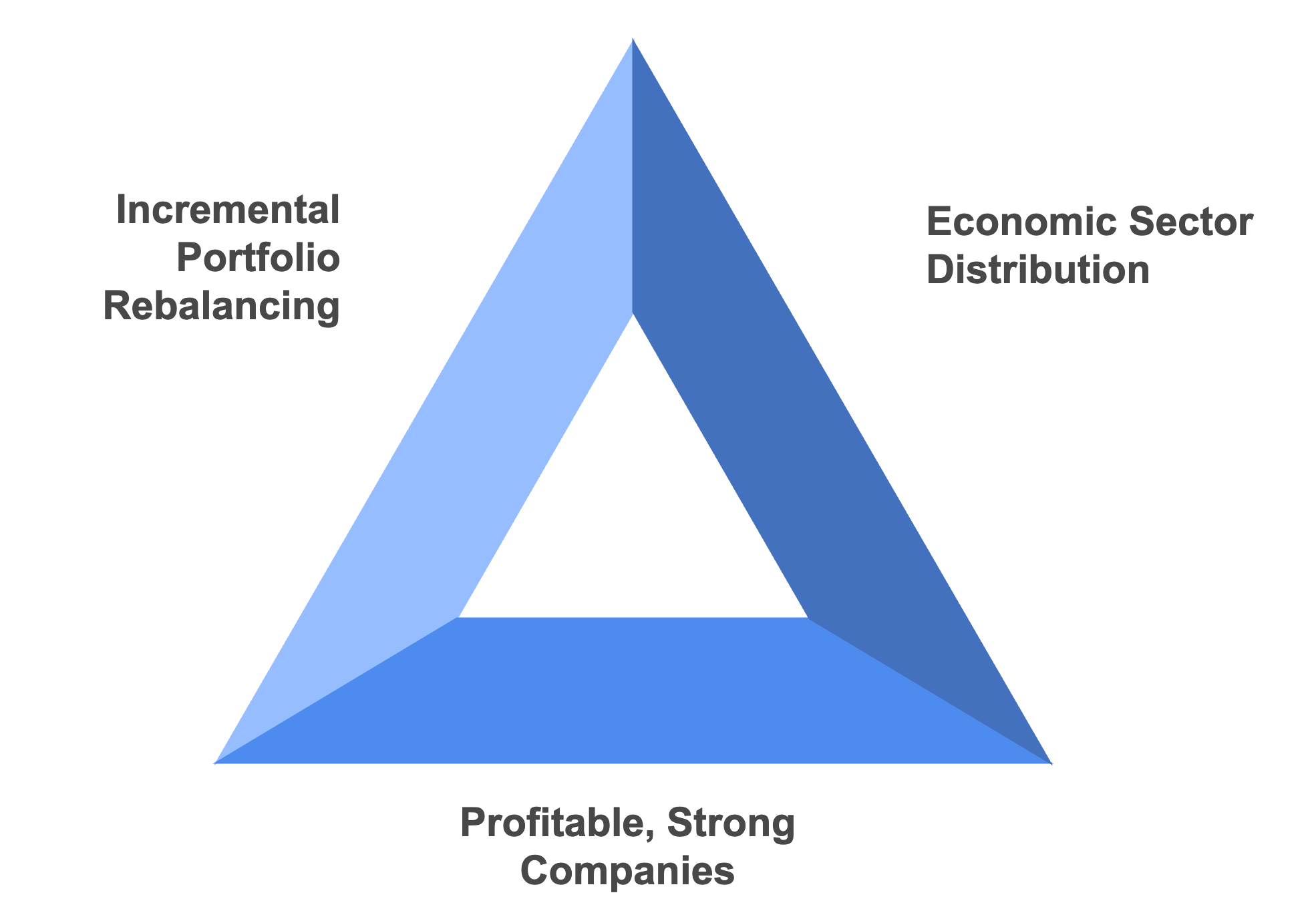

Investment candidates tend to be distributed across major economic sectors. The commitment we make to a particular sector is based on our view of the opportunities and calculations within the sector, balanced against each client’s desire to reduce risk and preserve capital. Generally, we try to maintain exposure to the major economic sectors; however if the risk of loss seems excessive, we will cut back or eliminate our position in a particular area.

Our equity holdings tend to be highly profitable, financially strong companies who are abundant generators of operating and free cash flow. We also look closely at a company’s record of capital allocation – companies that utilize their cash resources wisely tend to make better investments than those less disciplined.

Over the course of the economic cycle, different companies and sectors tend to move into and out of favor. We use these periods to enhance our clients’ portfolios by adding to positions which are temporarily out of favor and by reducing positions that seem excessively valued. These changes tend to be incremental, not dramatic. It has been our experience that sudden changes in portfolio strategy increase the risk of permanent loss.

“We prefer to take a 10-year perspective on our holdings. It keeps us focused on identifying stocks with a long-term opportunity for growth and avoiding stocks with short term momentum but long-term price risk.”

— Bob Bingham, CFA®, Founder of SKY Investment Group

Book a meeting.

How can we help with your investment needs? Fill out the form and we’ll be in touch shortly.

Info

Address

One Financial Plaza

Suite 1210

Hartford, CT 06103