Fourth Quarter 2025 Review and Commentary

January 9, 2026

Robert Bingham, CFA, President and Chief Investment Officer

John Wright, Principal, Senior Portfolio Manager

Jared Soper, Senior Portfolio Manager

Tyler Waterman, Director of Research, Portfolio Manager

Fourth Quarter 2025 Review and Commentary

“Skepticism and pessimism aren’t synonymous. Skepticism calls for pessimism when optimism is excessive. But it also calls for optimism when pessimism is excessive.”

– Howard Marks, Co-Founder of Oaktree Capital Management

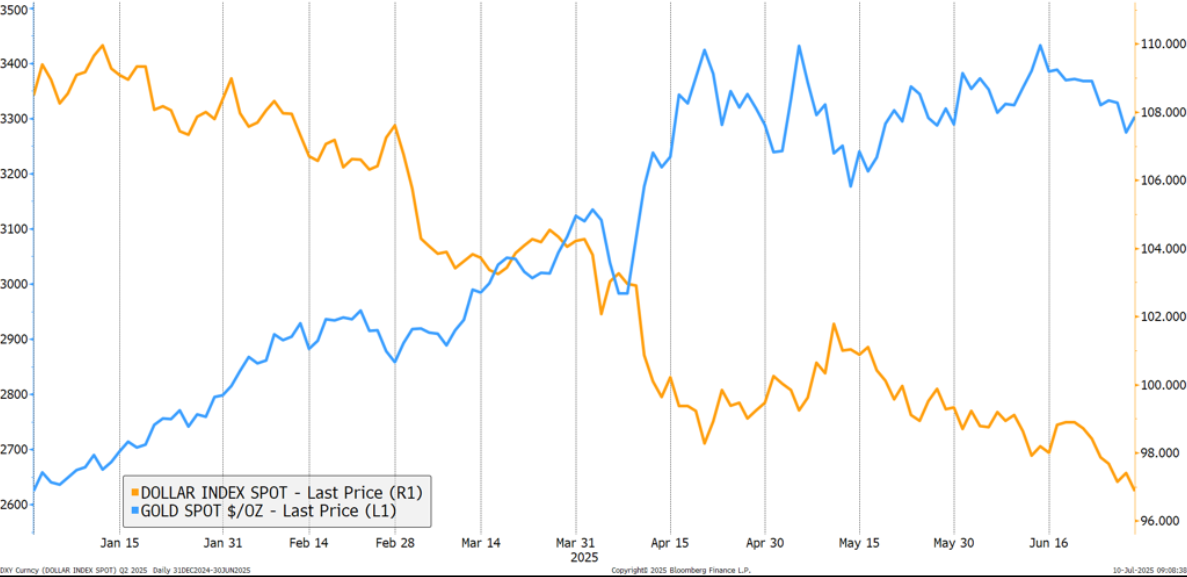

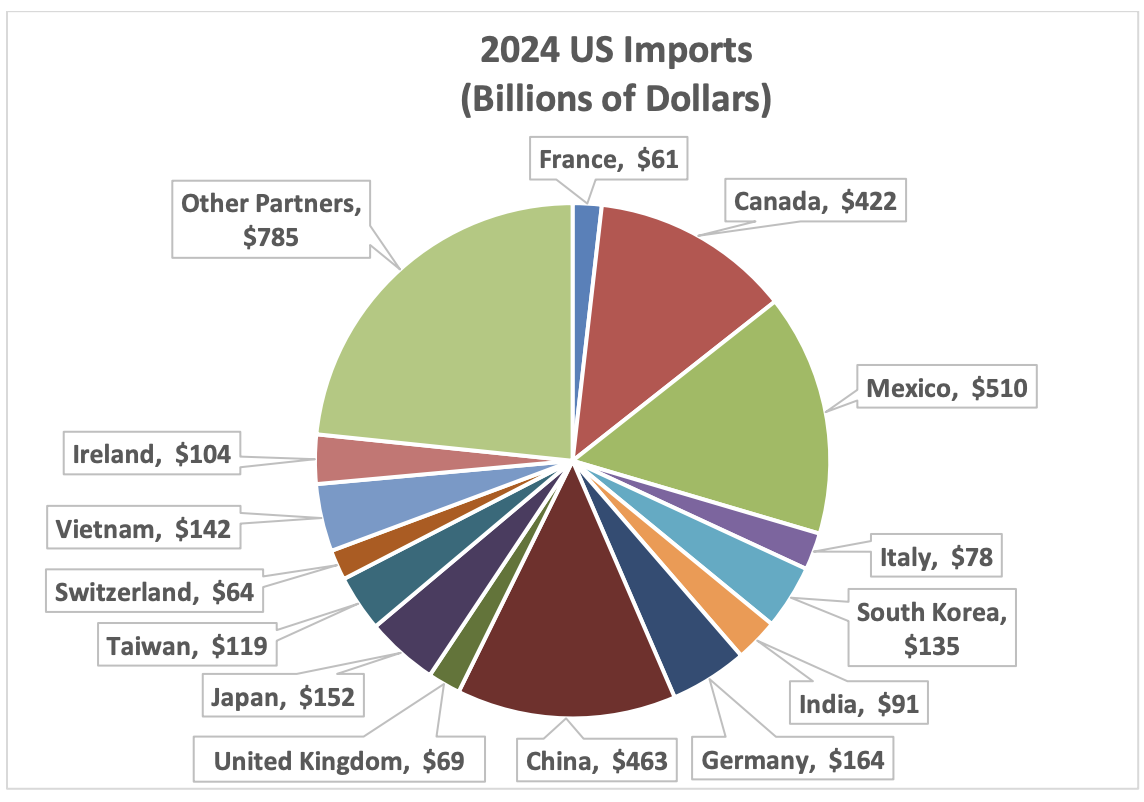

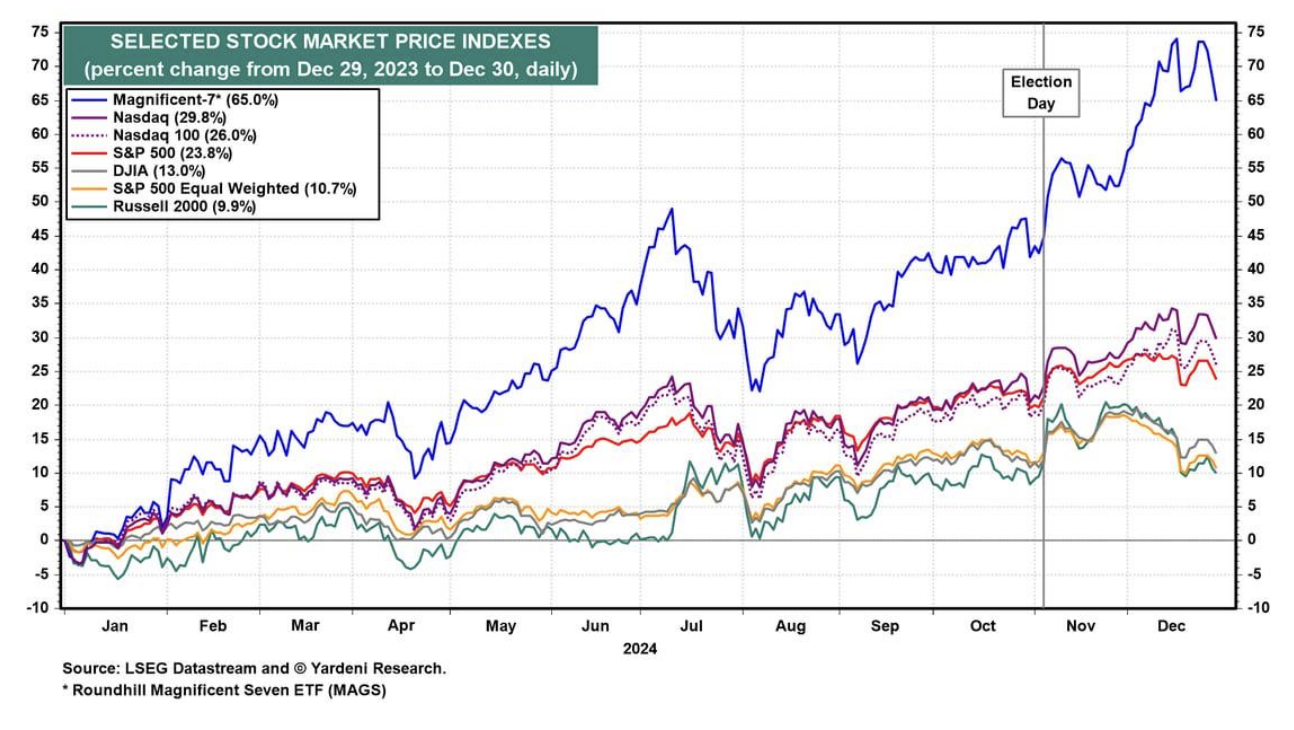

2025 marked another year of above-average market returns as the S&P 500 delivered a total return of 17.9%, driven once again by technology stocks and the Magnificent 7*. The year was not without volatility as investors combatted negative sentiment and risks related to tariffs, trade policy uncertainty, inflation, geopolitical tensions, a weak dollar, cracks in private credit, artificial intelligence (AI) valuation skepticism, a federal government shutdown, spikes in health care premiums, and rising unemployment levels.

Despite these headwinds, total returns were positive in all 11 sectors of the market, with communication services, technology, and industrials outperforming the S&P 500. U.S. stocks demonstrated their resilience with earnings per share growing over 10% as J. P. Morgan observed, “most of the cost of tariffs appear to have been absorbed by U.S. retailers.”

Now that 2025 is in the rearview mirror, investors have begun to focus on the prospects for sustained market momentum in 2026. We put together a list of key themes and our thoughts on the investment outlook over the next 12 months. Ultimately, we see a reasonably high probability that the market performs well as the drivers from last year carry into this year. However, we acknowledge that there are risks to our outlook that need to be considered, which we have also laid out.

Outlook for 2026

- Tax refunds this April from the passage of last year’s One Big Beautiful Bill Act should be stimulative and support consumer spending in the first half of 2026. Internal Revenue Service CEO Frank Bisignano predicted that Americans will receive the “biggest refunds we’ve ever seen” for the 2026 tax season.

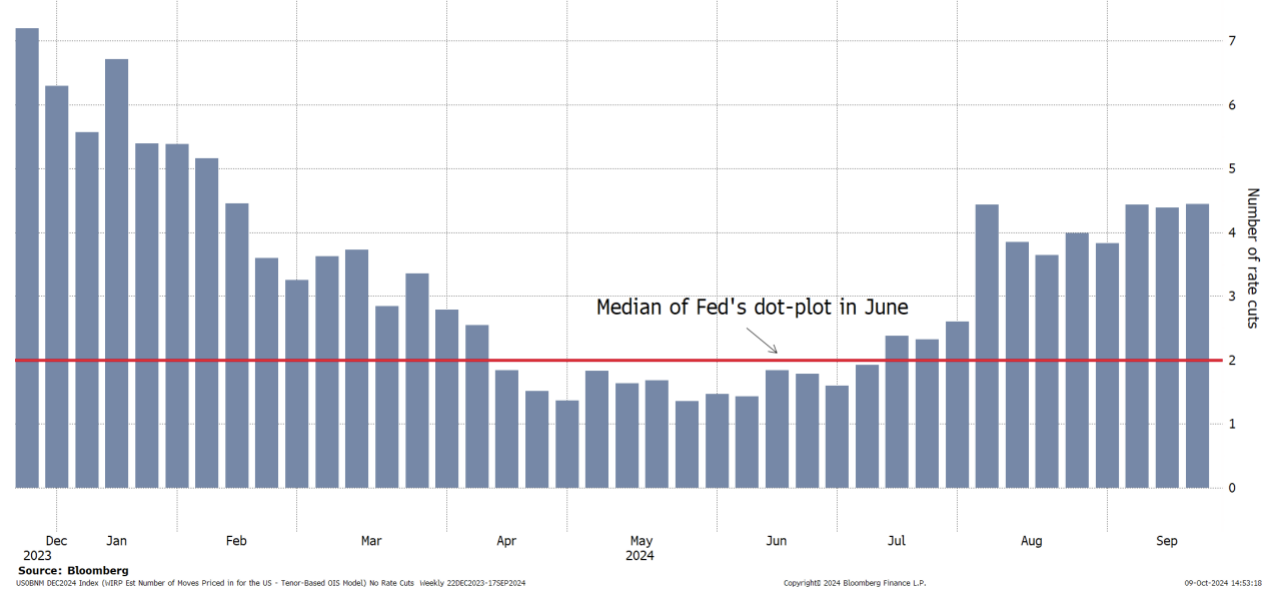

- Interest rates should continue to trend lower as Federal Reserve Chair Jerome Powell is likely to be replaced this spring by someone who favors additional rate cuts. The Fed Funds rate was most recently lowered by 25 basis points (bps) to a range of 3.5% to 3.75% at December’s Federal Open Market Committee (FOMC) meeting. The Fed also decided to initiate purchases of shorter-term Treasuries, which will be stimulative in combination with further rate cuts.

- Bond markets should perform well in a declining interest rate environment.

- Oil prices are likely to remain depressed after declining around 20% last year as demand stays muted and efforts are made to bring an end to the Russia-Ukraine war. Lower oil and gasoline prices would help keep inflation low and support the U.S. administration’s desire to see more interest rate cuts. A greater supply of oil shipments from Venezuela after U.S. intervention might further amplify the oil supply-demand imbalance and help to push prices lower.

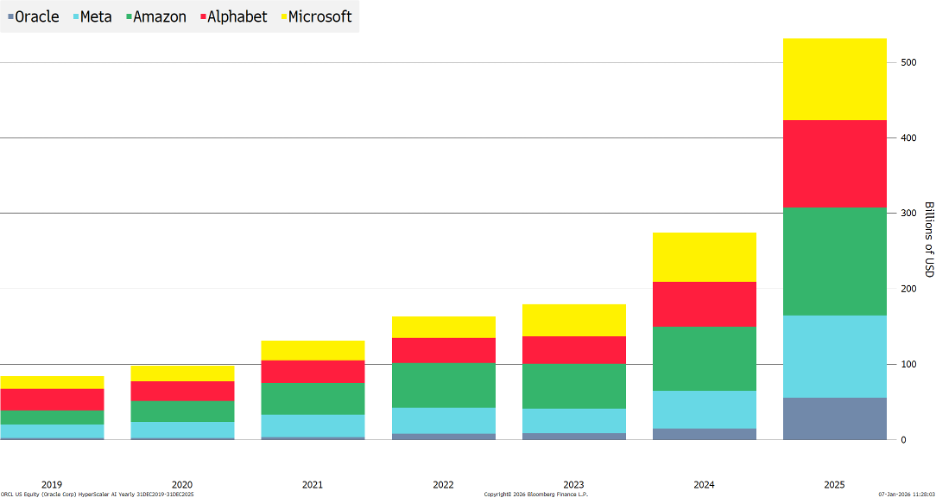

- Capital expenditures (CAPEX) related to artificial intelligence investment and data center buildouts, driven by large cloud service providers and data center operators (hyperscalers), will remain elevated and drive earnings growth for AI-related companies. A chart of CAPEX growth among the top 5 hyperscalers can be seen below. The figure is expected to increase in 2026, with some estimates exceeding $600 billion.

Hyperscaler Capital Expenditures

- Industrials should continue to outperform as onshoring continues and spending increases on infrastructure and aerospace & defense. Apple is leading the way, announcing a four-year, $500 billion U.S. investment early last year.

- Financials, particularly banks and other interest rate sensitive industries, should continue to do well in an environment where the yield curve is steepening.

- Gross Domestic Product (GDP) growth is expected to be slightly more than 2%. The median participant of the FOMC’s Summary of Economic Projections (SEP) projects that real GDP will rise 2.3% in 2026, up from 1.7% in 2025. Jerome Powell commented that were it not for the government shutdown last fall, real GDP growth projections would have been around 1.9% in 2025 and 2.1% in 2026.

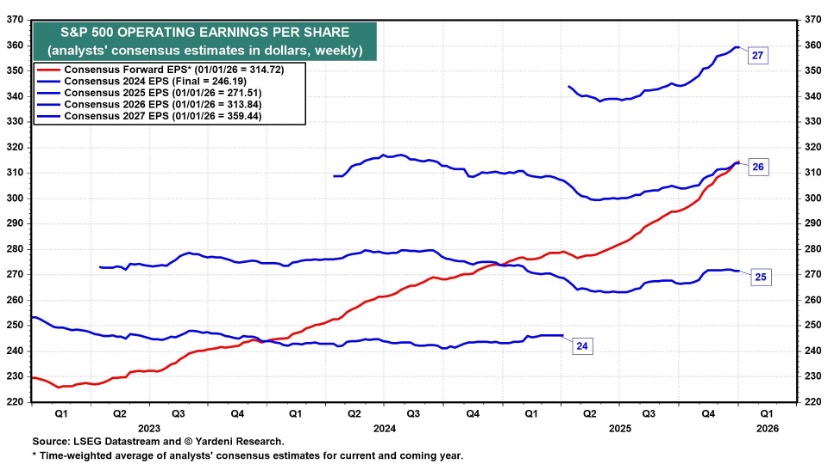

- S&P 500 earnings per share (EPS) growth is projected to be around 15% over the next 2 years based on consensus estimates. S&P 500 EPS estimates can be seen in the chart below.

- Corporate margins should expand and productivity should continue to improve as companies integrate AI solutions in their operations and reconfigure their workforces.

These catalysts provide a compelling fundamental case for growth in 2026, but they do not exist in a vacuum. As Howard Marks reminds us, the key to navigating such an environment is distinguishing between objective reality and market sentiment.

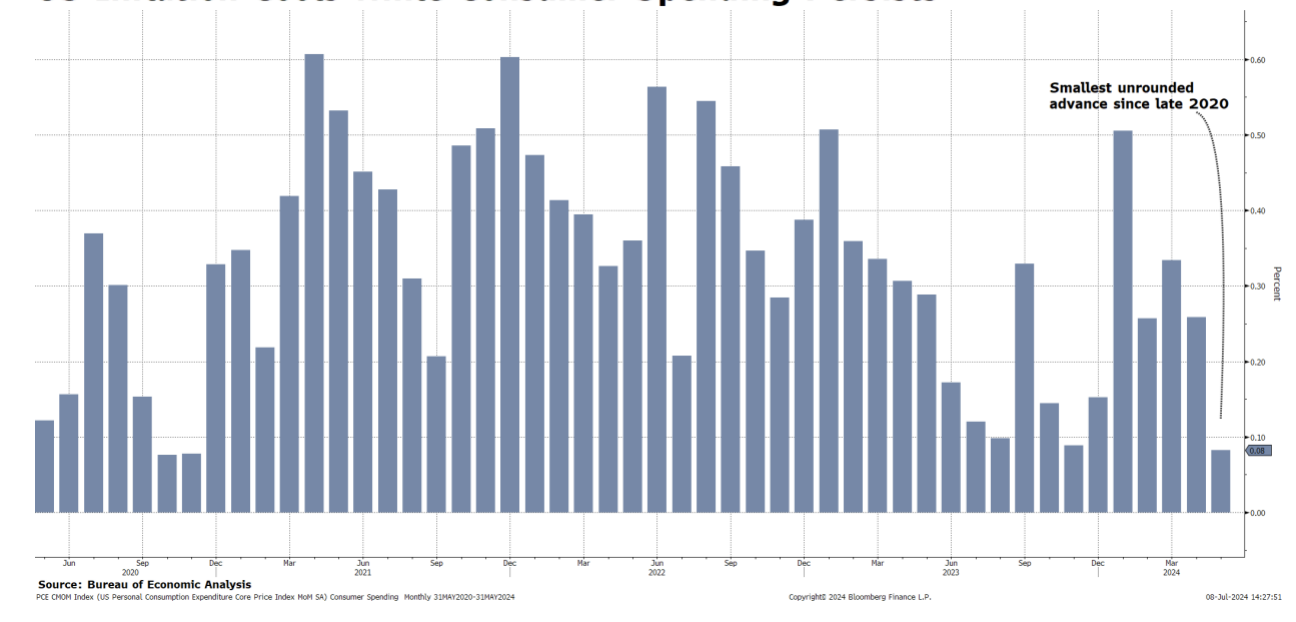

Sustaining this momentum requires a delicate balance between inflation staying cool enough for the Fed to ease, and consumer spending staying hot enough to justify elevated corporate valuations. To maintain a truly skeptical posture, we must weigh these opportunities against the following set of risks that could alter the outcome of the year ahead.

Risks

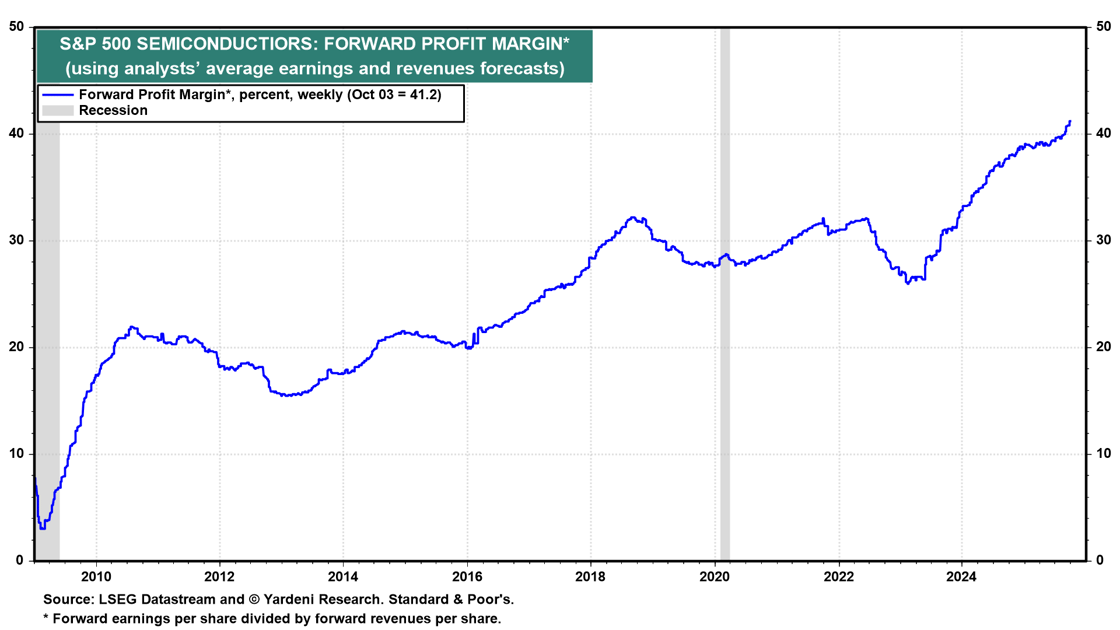

- One of the most significant concerns for investors this year is AI company valuations as the sustainability of their revenue growth and margin expansion is called into question. The possibility of a bursting “AI bubble” topped the ranking of the 15 largest risks for this year in a Deutsche Bank poll, with 57% of respondents placing it in their top three concerns for 2026. However, there has been increasing scrutiny of AI-related spending since the beginning of 2025’s fourth quarter, which we see as a healthy sign that the market remains skeptical and not excessively optimistic. Companies like Oracle and Broadcom ended the fourth quarter down 44% and 17% respectively from their highs as investors tempered their expectations following their earnings releases.

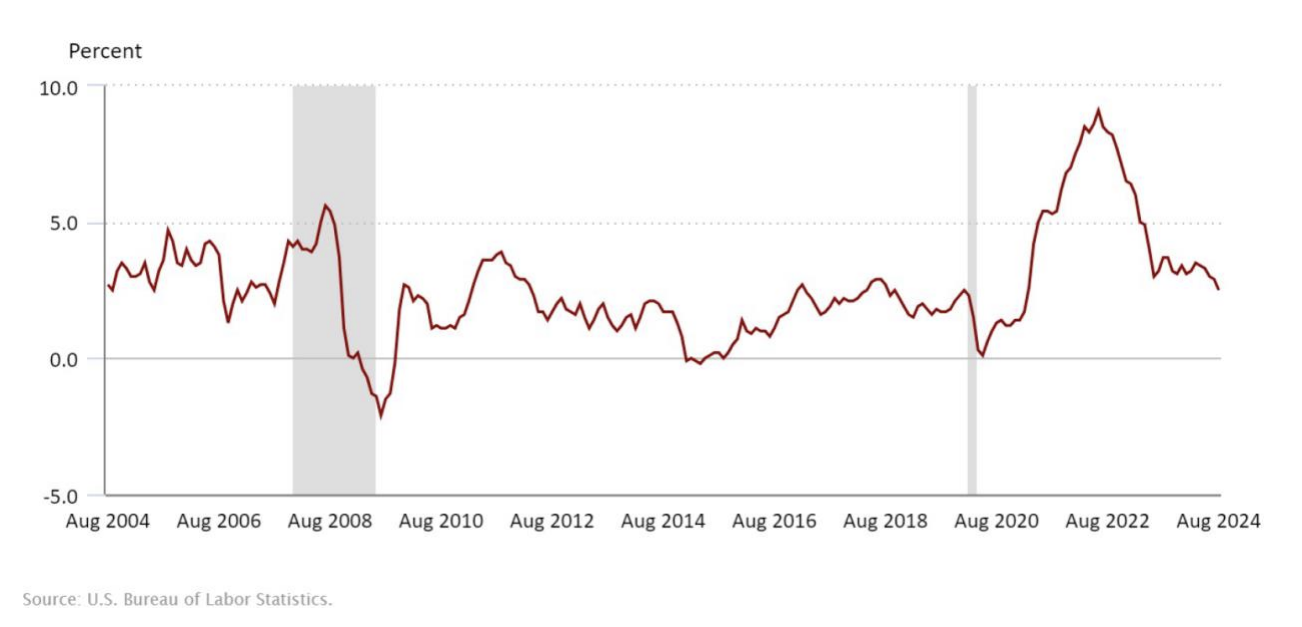

- There are also concerns about weakness in the labor market caused by lower hiring activity and lower labor force participation rates. However, Dr. David Kelly, Chief Global Strategist at J.P. Morgan, points out that the “impact of slow job growth on the unemployment rate should be mitigated by lower immigration.”

- There is a risk that we see higher inflation figures due to increased consumer spending when tax refunds are received this spring. Companies may choose to pass on more of their tariff costs in conjunction with rising consumer sentiment.

- Affordability issues will also likely persist, even as select tariffs on food items such as coffee and bananas, and more recently furniture and cabinets, have been rolled back or delayed in response to growing concerns. The Trump administration has also called for meetings with all the U.S.-based health insurers in the coming days, most likely to negotiate lower consumer health care costs.

- Concerns about deficits and geo-political events will also persist.

While 2026 will undoubtedly be marked by periods of volatility, such fluctuations are a common feature of a healthy market. In this environment, we encourage investors to view performance through the lens of a full market cycle rather than a single twelve-month snapshot. By prioritizing progress toward individuals’ specific financial goals, we can maintain the discipline necessary to endure these inevitable shifts.

Do please give us a call if you’d like to meet directly. All our best to each of you for a Happy and Healthy New Year!

Securities noted above valued as of the market close on October 8, 2025:

Advanced Micro Devices, Inc. (AMD $235.56) Alphabet Inc. Class C (GOOG $245.46)

Amazon.com, Inc. (AMZN $225.22) Broadcom Inc. (AVGO $345.50)

CoreWeave, Inc. (CRWV $139.98) Microsoft Corporation (MSFT $524.85)

NVIDIA Corporation (NVDA $189.11) Oracle Corporation (ORCL $288.63)

These summary/prices/quotes/statistics contained herein have been obtained from sources believed to be reliable but are not necessarily complete and cannot be guaranteed. Errors and omissions excepted.

This is not a general recommendation to buy or sell any particular security. Such advice is given to each of our clients individually based on their particular financial goals and objectives, risk tolerance and investment experience. For advice regarding your individual portfolio, please contact your investment manager. The information displayed here is limited to the dissemination of general information on products and services and transactions cannot be completed via this website.

The charts included in this report are sourced from Yardeni Research.